Switzerland is a federal republic officially known as the Swiss Confederation and is divided. Foreign corporations have plenty of reasons to set up offices in Switzerland.

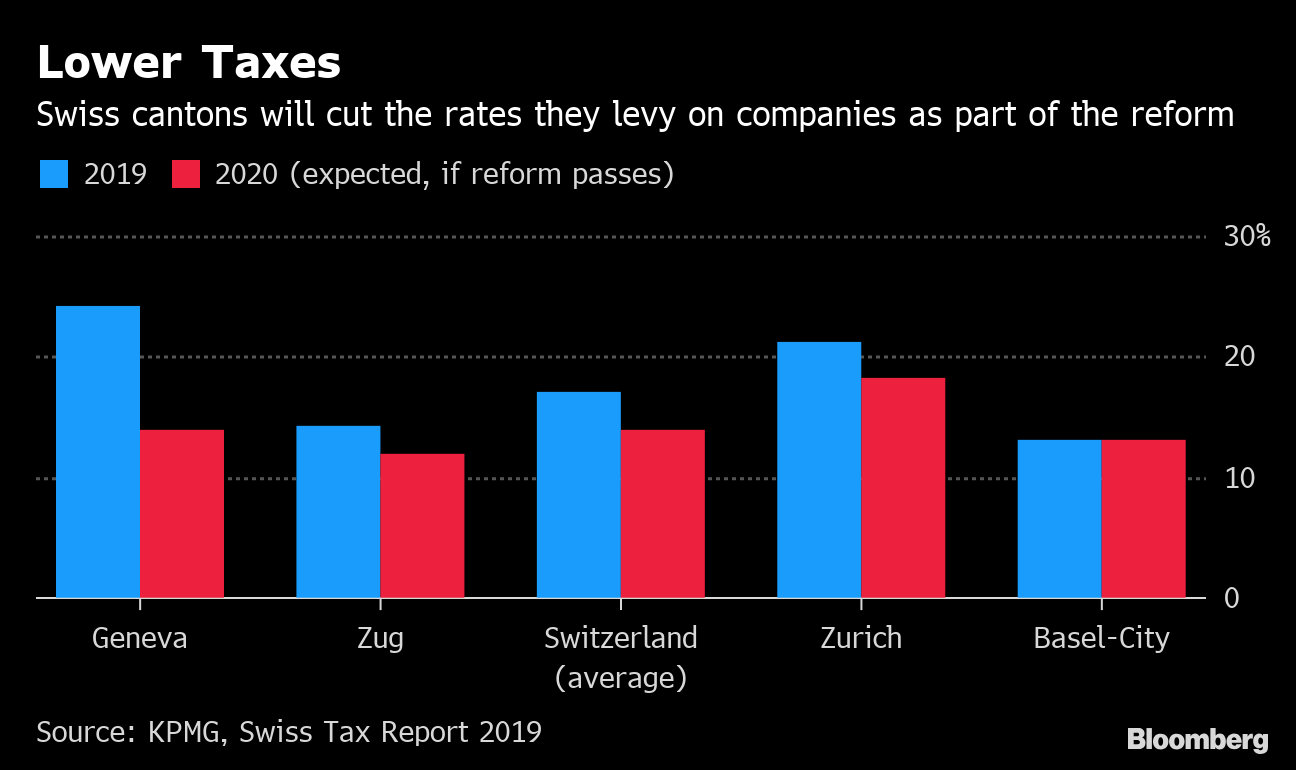

Switzerland Will Remain A Low Tax Centre For Big Firms The Economist

Switzerland Will Remain A Low Tax Centre For Big Firms The Economist

However a range of.

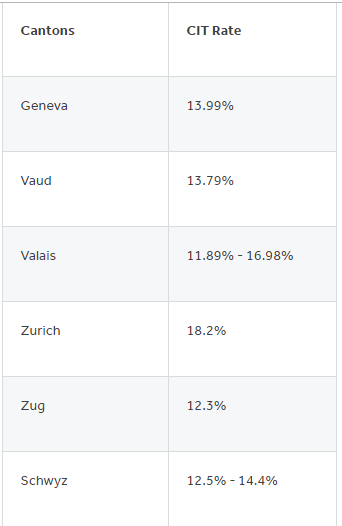

What is the tax rate in switzerland. If the full value of your items is over. Switzerland is an attractive destination for foreign business owners and investors thanks to its low tax rates. As a matter of principle proceeds of sales made and services provided in Switzerland are subject to VAT at the standard rate of 77 the applicable rate was 8 prior to 1 January 2018.

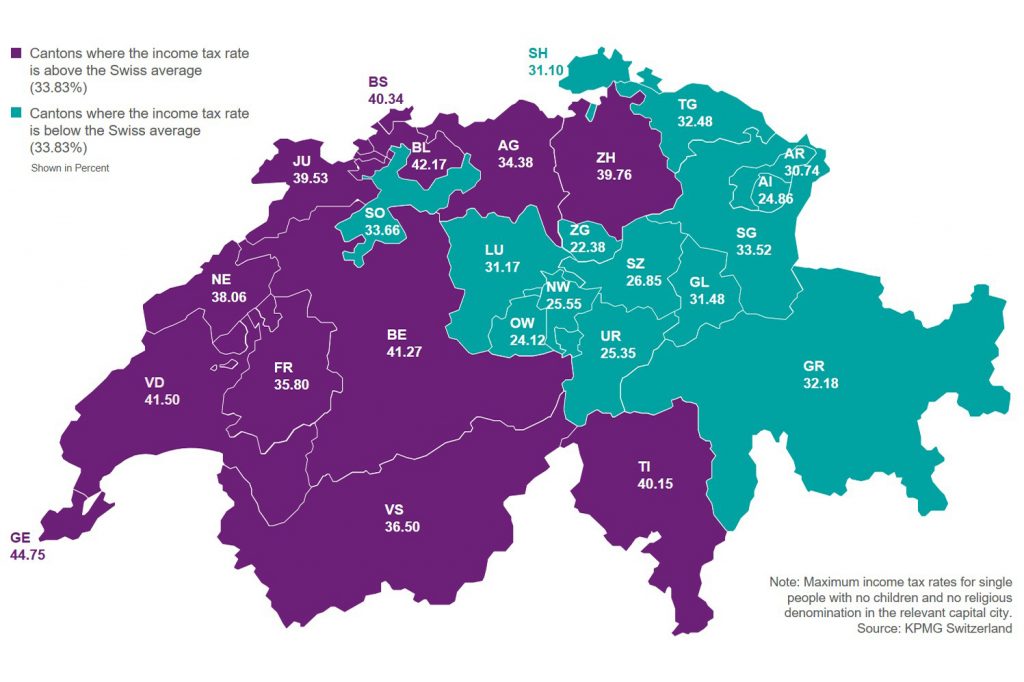

This means that the tax laws and tax rates vary widely from canton to canton. The maximum corporate tax rate including all federal cantonal and communal taxes is between 119 and 216. The OECD Taxing Wages 2017 report placed the average income tax rate in Denmark for an annual income of 412555 kroner just over 64000 Swiss francs at 362.

Income from F1450001. Swiss Federal Tax Administration. In general interest and dividend income derived from Swiss sources is subject to a 35 withholding tax WHT which tax has to be withheld from the paying party eg.

This limit is CHF 120000 for the Confederation only exception Geneva. For example if the declared value of your items is. Switzerland Single Federal Income Tax Tables in 2020.

Wealth tax is levied on the value of an individuals assets minus the value of any debts. The import tax on a shipment will be. Income from F3160001.

Goods for basic needs are subject to VAT at the reduced rate of 25 this rate remained unchanged. The highest marginal income tax rate applied in Denmark is 5195. Income tax in Switzerland for foreigners Switzerland tax rates.

The Personal Income Tax Rate in Switzerland stands at 40 percent. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. To avoid double taxation or generating income in two countries Switzerland operates Double.

If we pay attention at the other countries we can notice why Switzerland is considered to be a friendly one for crypto enthusiasts. Income tax rates also vary enormously between cantons and municipalities. For instance taxes on gains in Great Britain can be up to 45 in Canada this number can reach 50 while in Japan the taxes can be up to 55.

Personal Income Tax Rate in Switzerland averaged 4009 percent from 2004 until 2020 reaching an all time high of 4040 percent in 2005 and. Bank or Swiss company and is directly deducted from the gross amount paid to the recipient. You can get more information from the tax office in your.

In order for the recipient to receive a package an additional amount of. The tax at source rate differs from canton to canton. The national government offers significant tax breaks to companies that hold 10 shares of.

The federal Swiss corporate tax rate is a flat rate of 85 but additional cantonal and municipal rates can vary considerably. Wealth tax rates are progressive. Swiss wealth tax is levied at cantonal and local levels on your personal assets.

Income from F4140001. If you are a foreign worker resident in Switzerland for tax purposes and your income exceeds a certain limit a statutory assessment of your whole income and assets will be carried out. Based on the facts and circumstances this tax may be credited towards the overall income tax liability in.

They have the power to charge any tax that the Confederation does not claim exclusive rights over. The cantons are free to decide on their own tax rates. Switzerland has a bracketed income tax system with ten income tax.

Capital gains tax also exists in US. The Tax Free Threshold Is 0 USD.

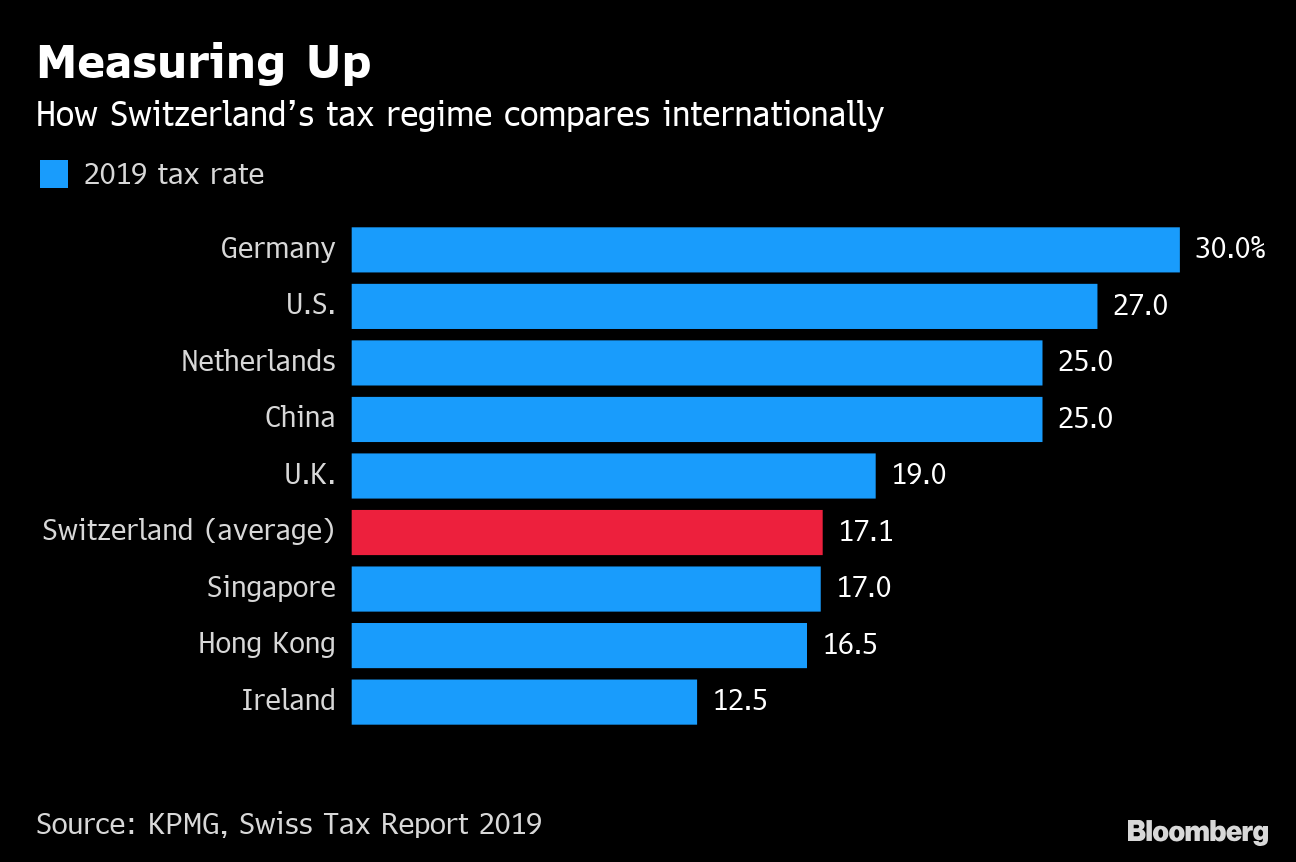

Switzerland Votes Yes To Being Tax Home For Big Business Bloomberg

Switzerland Votes Yes To Being Tax Home For Big Business Bloomberg

Sunset At Park St Michael Lugano Wopart

Sunset At Park St Michael Lugano Wopart

Taxes In Switzerland How Much Will You Pay In Taxes

Taxes In Switzerland How Much Will You Pay In Taxes

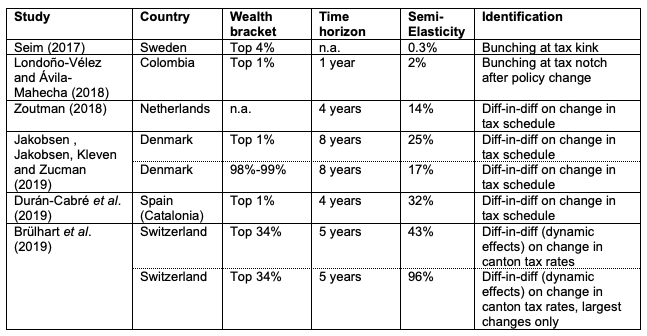

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Flow Recruitment Placement Of Engineers And Specialists Into Swiss Industry And It Recruiting Specialists From The Eu

Swiss Corporate Tax Overhaul Faces Big Test Wsj

Swiss Corporate Tax Overhaul Faces Big Test Wsj

Why You Should Consider Switzerland As Part Of Your International Tax Planning Arrangements

Taxation In Switzerland Wikipedia

Taxation In Switzerland Wikipedia

Taxation In Switzerland Wikiwand

Taxation In Switzerland Wikiwand

Why It S Time To Talk About Corporate Tax Particulieren Schroders

Why It S Time To Talk About Corporate Tax Particulieren Schroders

Switzerland Votes Yes To Being Tax Home For Big Business Bloomberg

Switzerland Votes Yes To Being Tax Home For Big Business Bloomberg

Everything You Need To Know About Swiss Company Formation Procedures Full Guide Offshorecorptalk

Comments

Post a Comment