Lees onze tips voor een goed plan. Loan funds can be used for the following.

Office Of Minority And Women S Business Enterprises

Office Of Minority And Women S Business Enterprises

The Minority Business Enterprise Loan Program provides loans to socially and economically disadvantaged minority and women-owned businesses as designated by the Mississippi Development Authoritys Minority and Small Business Development Division.

Minority business enterprise loan program. Purchase andor improve land and buildings. Pursuant to the Mississippi Code of 1972 as amended at 69-2-134 the MBELP is. The business must be organized for profit and perform a commercially useful function.

Advertentie Wilt u een eigen business starten of bent u pas gestart. 15 maanden gratis voor starters. Personal guarantees or business and corporate guarantees as appropriate other security as deemed appropriate by the URA.

The NMSDC provides its corporate members with access to the NMSDCs online database of certified MBEs. 15 maanden gratis voor starters. 1 year Loan Terms.

On top of the loan a minority-owned business loan from Accion comes with entrepreneurial guidelines meant to ensure that the borrower gets a certificate for their business and so on. Lees onze tips voor een goed plan. The Minority Business Enterprise MBE Loan Program provides loans to socially and economically disadvantaged minority and women-owned businesses as designated by the Mississippi Development Authoritys Minority and Small Business Development Division.

Advertentie Wilt u een eigen business starten of bent u pas gestart. MINORITY BUSINESS ENTERPRISE LOAN PROGRAM MBELP Purpose and Regulatory Authority The MBELP is designed for the purpose of providing loans to socially and economically disadvantaged minority or women owned small businesses. These organizations provide business consulting procurement matching and financial assistance to minority-owned firms.

As of January 1 2021 the Personal Net Worth Cap applied to the Minority Business Enterprise MBE program will increase from 1771564 to 1788677. For more information please click here. The Minority Business Enterprise Loan Program provides loans to socially and economically disadvantaged minorities and women owned businesses as designated by the Minority and Small Business Development Division of the Mississippi Development Authority.

The National Minority Supplier Development Council NMSDC is the nations leading third-party certifier who certifies companies as minorities-owned business enterprises MBEs on behalf of the private sector US. Minority business owners can borrow anywhere from 75000 to 500000 from the BCF through their Direct Lending Program in the form of either a term loan or line of credit. The Bridge to Success Loan Program aims to provide qualified Minority and Women-owned Business Enterprises MWBEs with access to short-term bridge loans necessary to execute contracting opportunities across New York State.

To be eligible for funding under this program the business must be certified as a minority business by the State of Mississippi. Minorities can still benefit from the. The total project amount eligible for consideration under this program will be a minimum of 200000 up to a maximum of 3500000.

THE MINORITY BUSINESS ENTERPRISE MICRO LOAN PROGRAM Micro Loan To be eligible for assistance the business enterprise must be a socially and economically disadvantaged small business concern. The program may be used to finance 100 of a total project. The Minority Business Loan Mobilization Guaranty Program helps Arkansas state-certified minority businesses with loan guarantees from 10000 up to 100000.

Start met het meest eenvoudige boekhoudprogramma. To be eligible you must certify your business as a minority business enterprise through the National Minority Supplier Development Council NMSDC. MBDA does not provide loans or grants to start or expand your business.

Program Terms and Conditions. Minority Entrepreneurs Struggled to Get Small-Business Relief Loans A year after the Paycheck Protection Program started studies show how its design hurt Black- and other minority-owned businesses. 0 for first year 2 for balance of loan term Loan payment deferral period.

To qualify the business must be a state-certified minority business enterprise in business for at least two years. The ownership and daily management of the. Up to 100000 Interest rate.

The grants MBDA does provide are to organizations that operate MBDAs Minority Business Centers throughout the United States. Start met het meest eenvoudige boekhoudprogramma. Beware of Spam Email.

Funding Options For Minority Owned Businesses

Funding Options For Minority Owned Businesses

Minority Business Development Agency Mbda Tacoma Business Center City Of Tacoma

Minority Business Development Agency Mbda Tacoma Business Center City Of Tacoma

Minority Business Loans How To Find And Apply For Small Business Loans For Minorities Nav

Minority Business Loans How To Find And Apply For Small Business Loans For Minorities Nav

Small Business Loans For Women Funding Circle

Small Business Loans For Women Funding Circle

Small Business Loans For Minorities Guide Fundbox

Small Business Loans For Minorities Guide Fundbox

A Guide To Small Business Loans For Minorities Funding Circle

A Guide To Small Business Loans For Minorities Funding Circle

Minority And Women Business Enterprise Certification Program

Minority And Women Business Enterprise Certification Program

How To Get Certified As A Minority Owned Business Inc Com

How To Get Certified As A Minority Owned Business Inc Com

Minority And Small Business Certification

Minority And Small Business Certification

![]() The Ultimate Guide To Minority Business Loans Excel Capital

The Ultimate Guide To Minority Business Loans Excel Capital

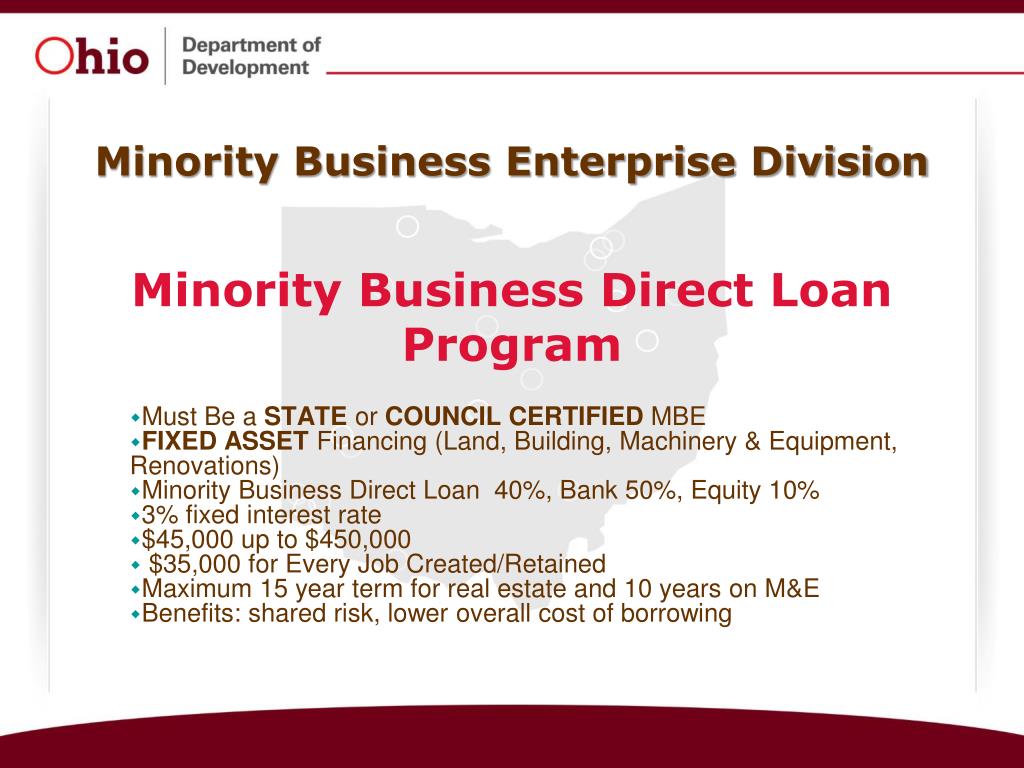

Ppt Minority Business Enterprise Division Powerpoint Presentation Free Download Id 867835

Ppt Minority Business Enterprise Division Powerpoint Presentation Free Download Id 867835

Ppp Loan Program Has Been Extended Through August 8th National Minority Supplier Development Council

Comments

Post a Comment