How Do I Short the Market. First focus on an equity exchange-traded fund.

Short Position Meaning Example How Short Position In Stocks Works

Short Position Meaning Example How Short Position In Stocks Works

Open a short position.

How do i short the market. My time frame is several months. 21 Ways to Aggressively Short This Market The most bearish of the bears favor these leveraged ETFs By Jeff Reeves Jun 24 2013 1213 pm EDT June 24 2013. Enter your short order.

When you decide to complete the trade buy that same number of shares on the open market then return them to. There are many ways to profit from falling prices during a downtrend. Finally there are exchange-traded funds.

When you short the market you borrow shares from a broker-dealer and try to make money on them before returning the shares. Im sharing this trade so that everyone gets to ridicule me and hail me as a moron and have fun at my expense in the comments for weeks and months every. Second use an ETF that tracks the broader market.

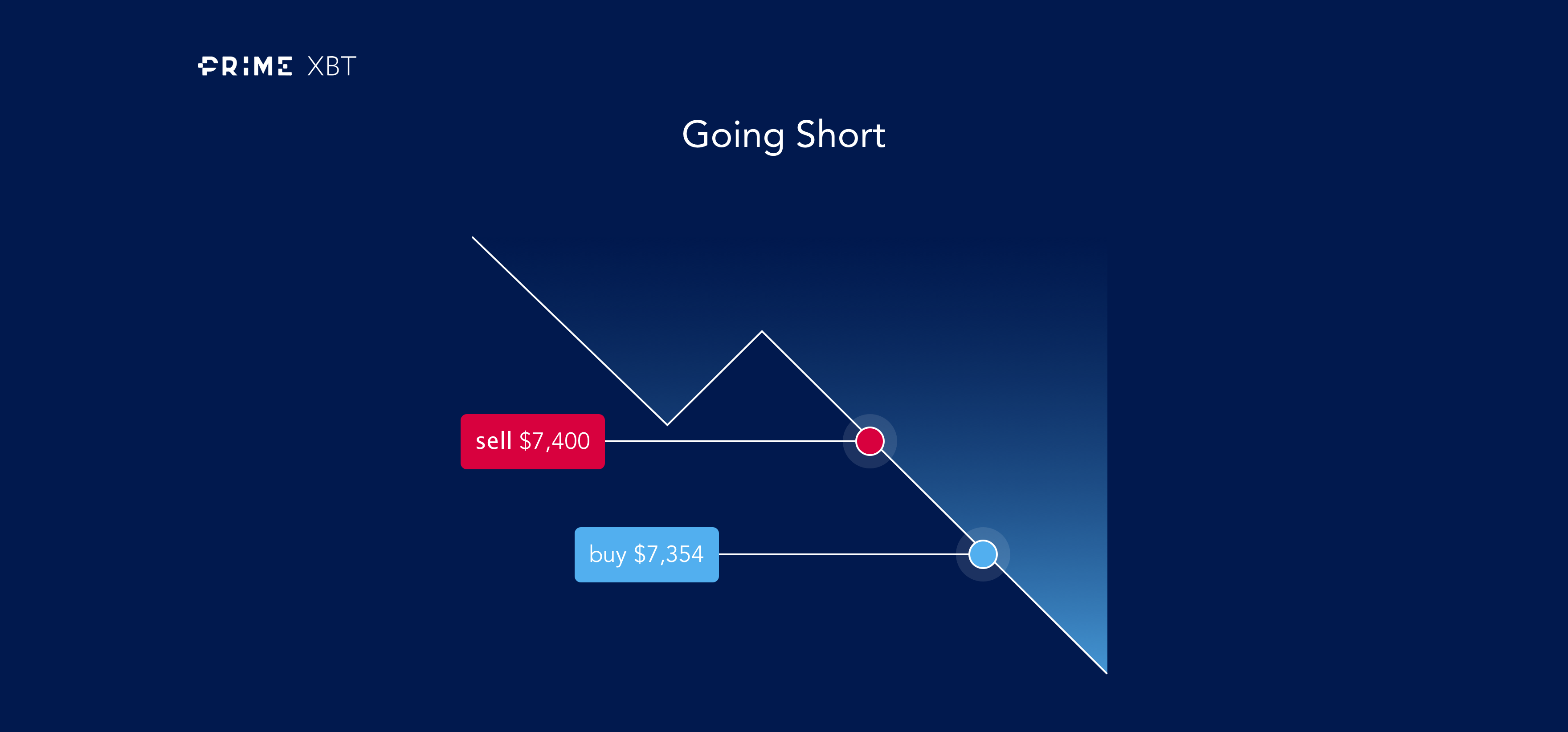

Traders can short-sell the market by borrowing securities from their broker selling them in the market at the current market price and repurchase them later at a lower price making a profit on the difference between the selling and buying price. How Do You Short the Market. In a short sale the sale comes first.

These are the simplest and most conservative way to short the market. While the position is open you typically need to pay interest on the value of the borrowed shares. Shorting stock also known as short selling involves the sale of stock that the seller does not own or has taken on loan from a broker.

You sell high creating a negative position then you buy low to cover and keep the difference in profits. Figure by Barry Burns. We dont need to know what the market will do ahead of time because we are fast enough to react to events as they happen.

Market has built in monetary policy inflation over time to grow in long term. As we are still several hundred points above the extreme line this small downward move will not have much of an impact on market volatility. I think the better question I would like to ask you is why would you want to bet against the market in Long term.

You might think its shorting the SPDR SP 500 ETF NYSEARCA. You believe that the market is going to fall so you take a short position with your broker on a particular stock. That is they go up when the market goes down and they go down when the market.

To obtain the right to sell shares short first borrow the shares through your broker then sell them. Derivatives contracts on bonds such as futures and options provide one way to short the bond market or to hedge an existing long position from a. There are three standard ways to short the stock market.

Its exactly the same principle of buy low sell high just in the reverse order you sell high and then buy low. Identify the stock that you want to sell short. Its just nuts to short this market that is even crazier than in late 1999.

Given the slightly higher betas associated with. But this morning I shared in a comment in our illustrious comment section that Id just shorted the SPDR SP 500 ETF SPY. For the very first time in many many months V readings dropped by 60 points to 3140.

These are mutual funds and exchange-traded funds ETFs built to profit whenever the underlying index declines. Open a position to sell the stock you want to short Monitor the market price to see if your prediction was correct If the market fell as predicted youd close your position by buying back the shares at a lower price and profit from the difference in price. You first need to open a margin account and borrow shares from a broker-dealer.

Shorting the market consists of taking a bearish stance on the market rather than a bullish one. If you follow this straightforward methodology you might want to consider shorting the broad. Rather than short the.

How To Short The Market. Investors follow these general steps to short the market. You see there are many ETFs that trade inversely to the market.

SPY or buying the ProShares UltraShort SP 500 NYSEARCA. The first option and by far the easiest for retail traders is to buy what is known as an inverse fund. Short selling also known as going short or shorting the market means that youre selling the market first and then attempting to buy it later at a lower price.

One of the reason why we dont use gold or silver bac. Investors who short stock must be willing to take on the risk that their gamble might not work. Shorting the Market Basics.

In order to sell something you must have the right to sell it. Make sure that you have a margin account with your broker and the necessary permissions to open a short position in a stock.

How To Short A Stock Short Selling A Stock Ig En

How To Short A Stock Short Selling A Stock Ig En

Gamestop S Wild Ride How Reddit Traders Sparked A Short Squeeze Financial Times

Gamestop S Wild Ride How Reddit Traders Sparked A Short Squeeze Financial Times

Shorting A Stock Beginner S Guide To Short Selling Ota Investment Portfolio Online Trading Stock Market

Shorting A Stock Beginner S Guide To Short Selling Ota Investment Portfolio Online Trading Stock Market

Profit From The Falling Markets Short Selling Explained By Primexbt Prime Xbt Blog Has Moved To Primexbt Com Blog Medium

Profit From The Falling Markets Short Selling Explained By Primexbt Prime Xbt Blog Has Moved To Primexbt Com Blog Medium

What Is Short Selling Of Stocks Quora

How To Short A Stock Short Selling A Stock Ig En

How To Short A Stock Short Selling A Stock Ig En

How To Short The Housing Market Real Estate And Reits Ig En

How To Short The Housing Market Real Estate And Reits Ig En

Short Selling Stocks A Short Selling Example Firstrade

Short Selling Stocks A Short Selling Example Firstrade

/the-basics-of-shorting-stock-356327-v2-5bc4c22346e0fb0026b436d3.png)

/the-basics-of-shorting-stock-356327-v2-5bc4c22346e0fb0026b436d3.png)

Comments

Post a Comment