Self is a free credit monitoring system. You dont need good credit or money upfront to qualify.

Self Lender is a credit monitoring platform.

What is self lender. It gives you access to your credit history at all times. At the time of publishing the details contained in this review still apply to its Credit Builder Account product. Self was known as Self Lender until it rebranded in August 2019.

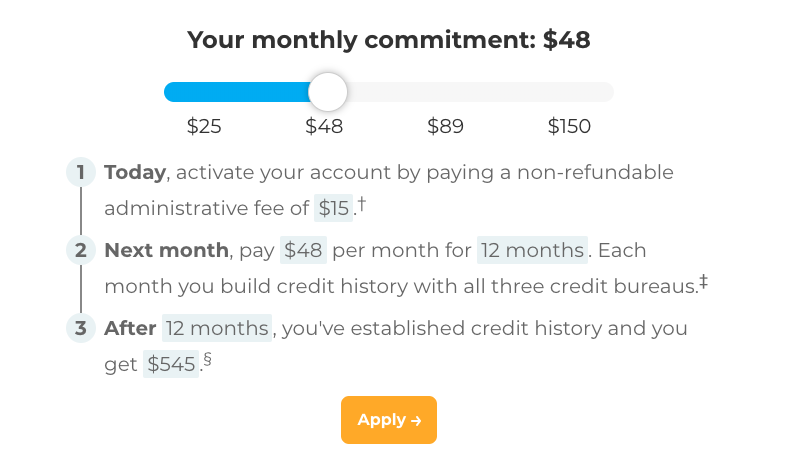

Once approved you will choose the dollar amount and the loan term that fits your budget. And each time you make a monthly payment it will be reported all three major credit bureaus Experian Equifax and TransUnion. What Is Self.

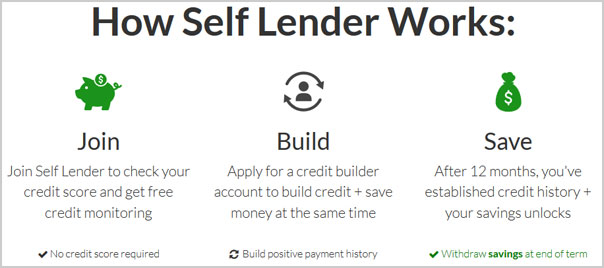

If you want to build credit while saving money little by little over time then Self might be right for you. Self is a financial technology company with a mission to help people build credit particularly those who are new to credit or who might not have access to traditional financial products. Self Inc formerly Self Lender is a fintech company founded in 2015 and headquartered in Austin Texas.

So basically youre taking out a small loan in your own name. The financial service they offer is a credit builder loan. Self Lender specializes in credit builder loans to help people build a positive payment history which is the most important factor of a credit score.

Please help me Thanks. Final Thoughts on Self formerly Self Lender Theres no doubt that Self is a clever product that addresses a real need. They track your credit score and give suggestions on how to improve it.

How Does Self Lender Work. Self Credit Builder Accounts are unsurprisingly exclusively designed for building credit. While many looking to build credit are likely to turn to credit cards or more traditional loan products Selfs loans seek to instill better financial habits in borrowers.

What Is Self Lender. Your monthly payment will depend on the size and length of your loan. Self is a perfect credit builder plan for someone who either doesnt have the cash to pledge for a secured credit card or a qualified and willing co-signer to cosign a loan.

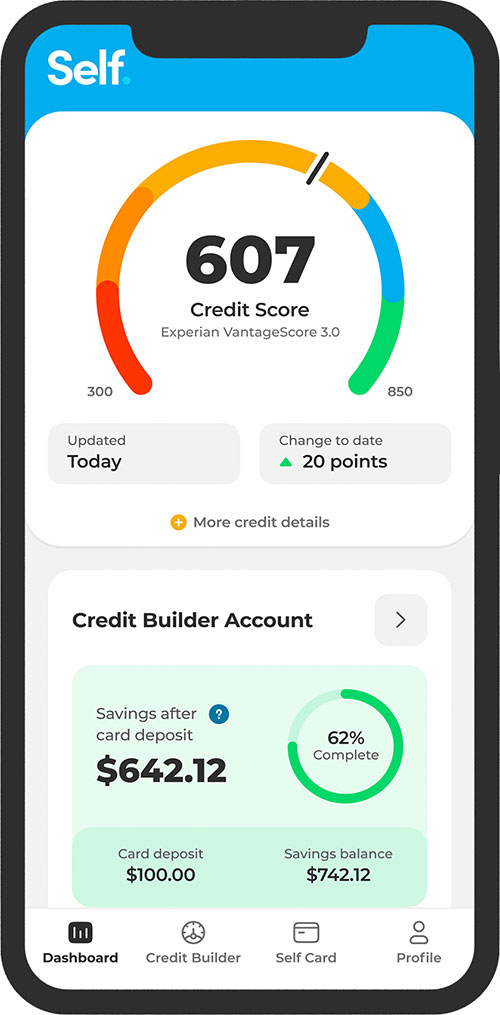

The suggestions are accurate and its easy to pull your score on demand. My fico score is 694. The company reports to all three major credit bureaus and provides customers with a user-friendly online dashboard.

Wanna get mortgage in 5 years. Thats where Self formerly Self Lender comes in. To take advantage of Self credit building loans you need to follow these simple steps.

The self lender program helps you build credit while saving money. Or should i do the alliant unsecured loan for 60 months. Self Lender partners with two companies who offer.

But they also offer credit building loans. Self Lender Review - CREDIT BUILDER Loan BOOST your CREDIT SCORE FAST Lets review Self Lender Credit Builder Loan its pros and cons and whether I reco. Self is a type of credit-builder loan that does not require a cash deposit right at the start.

The suggestions are accurate and its easy to pull your score on demand. Send us a note at helloselfinc. Im on my first self lender 12 months.

Create a Self Lender account. Selfs credit builder loans last 12 or 24 months and the interest on the loan is a variable APR. Self credit monitoring service gives you on-demand access to your credit score.

They track your credit score and give suggestions on how to improve it. Self formerly known as Self Lender is a Texas-based company that provides a credit builder program in place of a traditional credit repair program. Self also offers suggestions on how to improve your credit.

Self Lender now known as Self is a Fintech company that allows you to open a credit builder account which is another name for a credit builder loan. After complete should i do second self lender for 24 months. Self is not providing financial advice.

The content presented does not reflect the view of the Issuing Banks and is presented for general education and informational purposes only. This is where they make their money. Self Lender partners with two companies who offer products that you can use to build your credit score.

As described above Self offers their Credit Builder Account which is a loan that runs for a term of between 12 and 24 monthsYou can choose the repayment plan that fits your budget. Self formerly Self Lender offers loans meant to help credit newbies or those with damaged credit. The way it works is you apply for a self lender account.

Self is a venture-backed startup that helps people build credit and savings. Once you start making your monthly payments on time the payments are reported to. Self Lender is a credit monitoring platform.

Earn Interest Build Credit And Save For The Future With Self Lender Credit Builder Accounts Cardrates Com

Earn Interest Build Credit And Save For The Future With Self Lender Credit Builder Accounts Cardrates Com

Self Reviews Formerly Self Lender Self Credit Builder Self Loans Nav

Self Reviews Formerly Self Lender Self Credit Builder Self Loans Nav

Self Lender Review A Different Way To Build Credit

Self Lender Review A Different Way To Build Credit

Self Lender Review A Way To Build Credit Through Saving

Self Lender Review A Way To Build Credit Through Saving

Self Lender Review A Credit Boosting Alternative To Credit Cards

Self Lender Review Pros Cons 2021

Self Lender Review Pros Cons 2021

Self Lender Awarded Inaugural Inclusive Fintech 50

Self Lender Awarded Inaugural Inclusive Fintech 50

Self Lender S Credit Builder Accounts Help Consumers Improve Credit While Growing Their Savings Badcredit Org Badcredit Org

Self Lender S Credit Builder Accounts Help Consumers Improve Credit While Growing Their Savings Badcredit Org Badcredit Org

Self Lender Review A Painless Way To Save Money And Build Credit Moneytips By Debt Com

Self Lender Review A Painless Way To Save Money And Build Credit Moneytips By Debt Com

Self Offers Credit Builder Loans Without Money Upfront Nerdwallet

Self Offers Credit Builder Loans Without Money Upfront Nerdwallet

Self Lender Rebrands To Self To Continue To Empower

Self Lender Credit Builder Review Guide By Jordan Parker

Self Lender Credit Builder Review Guide By Jordan Parker

Self Credit Builder Loans Formerly Self Lender

Self Credit Builder Loans Formerly Self Lender

Self Review Self Lender 2021 Better Than Secured Card Or Prepaid Card

Self Review Self Lender 2021 Better Than Secured Card Or Prepaid Card

Comments

Post a Comment