Review your PA return to see how this works. Visit the Internal Revenue Services web-site wwwirsgov for more information.

Https Njcpa Org Docs Default Source Stay Informed Pa Nj Tax Reciprocity Q A Pdf Sfvrsn 0

Forgives some taxpayers of their liabilities even if they have not paid their Pennsylvania personal income tax.

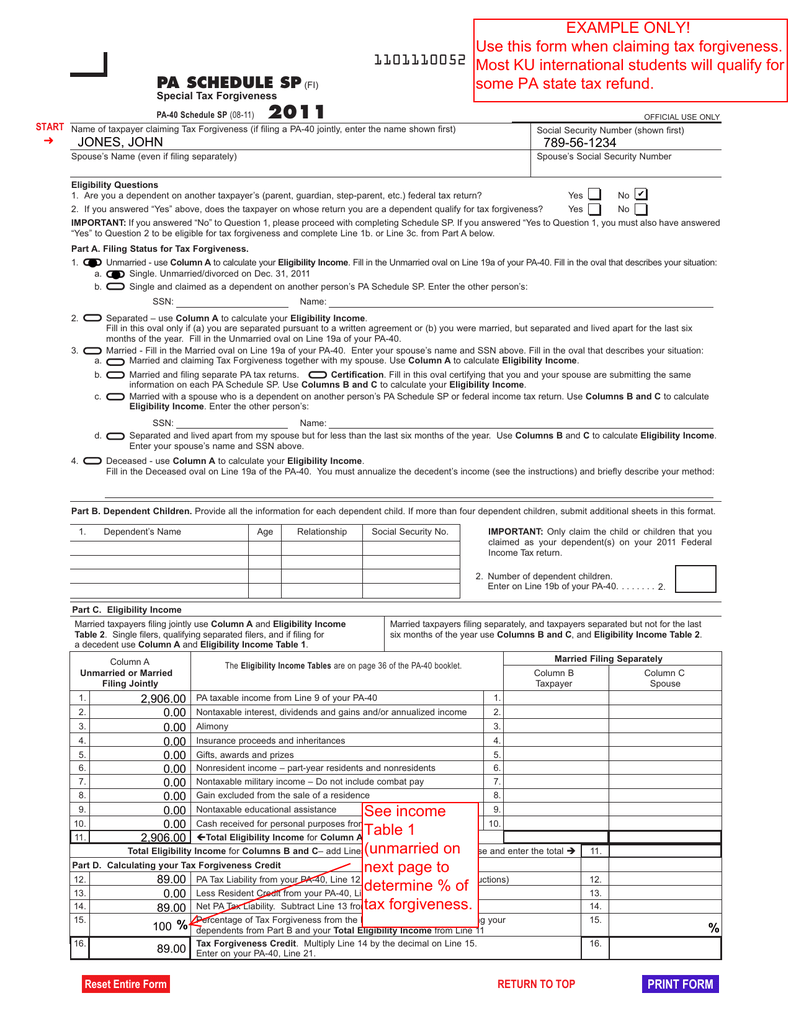

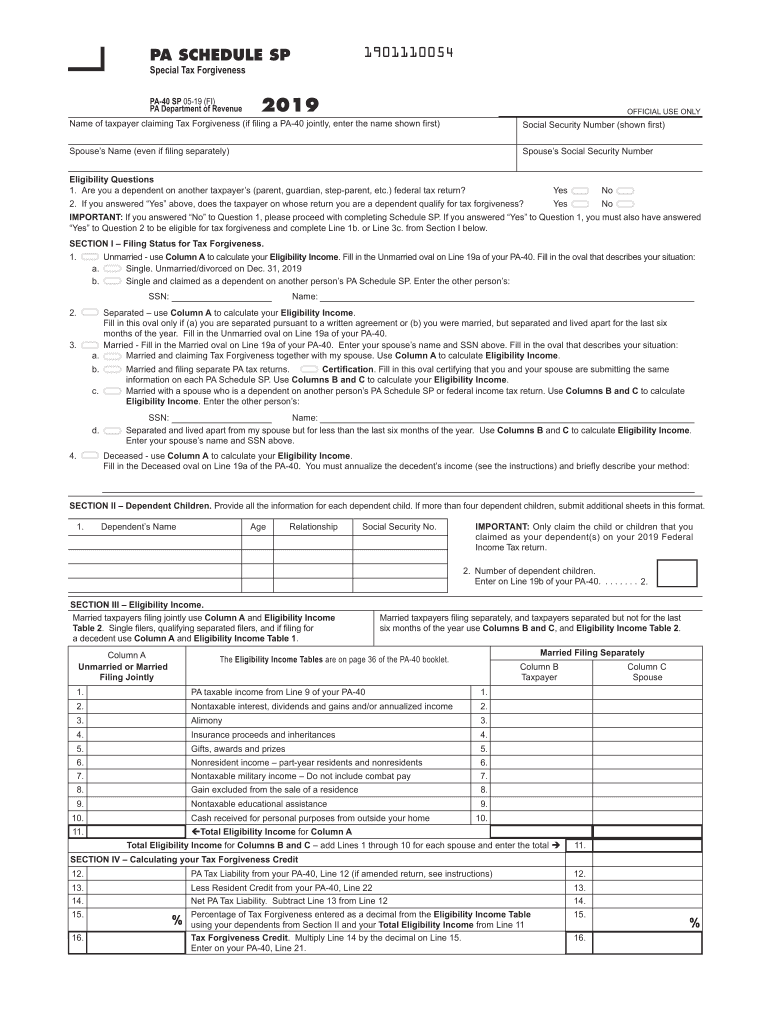

Pennsylvania special tax forgiveness credit. You can download or print current or past-year PDFs of Form PA-40 SP directly from TaxFormFinder. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. Tax relief can be a big help because it can reduce or even completely negate the taxes you owe.

What is Tax Forgiveness. The Resident Credit is a credit for gross or net income taxes paid to other states or foreign countries by Pennsylvania residents. Taxpayers eligible for PA Tax Forgiveness may also qualify for the federal earned income tax credit.

Who is Eligible for Tax Forgiveness. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. It is not a refundable credit.

The Tax Forgiveness Credit is extended to taxpayers who are single married andor have dependents and whose income from all sources including tax-exempt alimony child support and Social Security does not exceed certain. Unmarried and Deceased Taxpayers. Example 1 Keisha is a single parent.

Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Where do I enter this in the program.

If your Eligibility Income from PA Schedule SP Line 11 does not exceed. The qualifications for the Tax Forgiveness Credit are as follows. ELIGIBILITY INCOME TABLE 1.

Gifts awards and prizes- Include the total amount of nontaxable cash or property received as gifts. Different from and greater than taxable income. Families with two children making 50000 will have their taxes eliminated and families making less than 84000 will receive a tax cut.

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. Eligibility for working families depends on income and number of dependents. Tax Forgiveness is a credit that allows eligible taxpayers to reduce all or part of their PA tax liability.

You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax return. Insurance proceeds and inheritances- Include the total proceeds received from life or other insurance policies to include inherited cash or the value of property received.

You are subject to Pennsylvania personal income tax. You can go to the ForceSuppress the credit field at the bottom of the PA SP screen and from the drop list select F. Nearly one in five PA households qualify to reduce or eliminate their tax liability using tax forgiveness credits.

For more information on the amount you can receive view the full Eligibility Income Tables. PA Tax Forgiveness Examples. To determine eligibility taxpayers must first fill out the PA-40 personal tax return and the PA Schedule SP.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liabilityTo claim this credit it is necessary that a taxpayer file a PA-40 return and complete Schedule SPIt is not an automatic exemption or deduction. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. The amount of credit you qualify for depends on your filing status and your income level.

She earns PA taxable compensation of. She has twin boys she claims as dependents on her federal income tax return. I think my client qualifies for the PA special tax forgiveness credit but Schedule SP is not being produced.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. This will force the PASP to print so you can see why the taxpayer is ineligible for this credit. It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired.

A family of four with two working parents earning up to. You andor your spouse are liable for Pennsylvania tax on your income or would be liable if you earned received or realized taxable income You are not a dependent on another persons federal tax return. Gives a state tax refund to some taxpayers.

To enter this credit within the program please follow the steps below. About one in four Pennsylvania households qualifies for Pennsylvanias tax forgiveness program which allows families at or above the minimum wage and senior citizens to reduce a part or all of their state income tax liability. Under the governors plan the special tax forgiveness credit is expanded to reduce or eliminate taxes for working class families.

We last updated the PA Schedule SP - Special Tax Forgiveness in January 2021 so this is the latest version of Form PA-40 SP fully updated for tax year 2020. You can print other Pennsylvania tax forms here. Complete Tax Forgiveness Eligibility income starts with taxable income The eligibility income limit for 100 percent tax forgiveness is 6500 for the claimant 13000 for.

And Forgives some taxpayers of their liabilities even if they have not paid their PA personal income tax. Provides a reduction in tax liability and. Overall 67 percent of Pennsylvanians will get a tax cut or pay the same.

The Pennsylvania Tax Forgiveness Credit is a credit against Pennsylvania tax which allows taxpayers that are eligible to reduce all or part of their tax liability to PA.

Https Www Houseappropriations Com Files Documents Rev Sp Taxforgiveness Bp 012714 Pdf

Https Www Revenue Pa Gov Formsandpublications Papersonalincometaxguide Documents Pitguide Deductionscredits Pdf

2011 Pa Schedule Sp 1101110052

2011 Pa Schedule Sp 1101110052

Https Www Revenue Pa Gov Formsandpublications Formsforindividuals Pit Documents 2019 2019 Pa 40sp Pdf

Pennsylvania Tax Forms 2020 Printable State Pa 40 Form And Pa 40 Instructions

Pennsylvania Tax Forms 2020 Printable State Pa 40 Form And Pa 40 Instructions

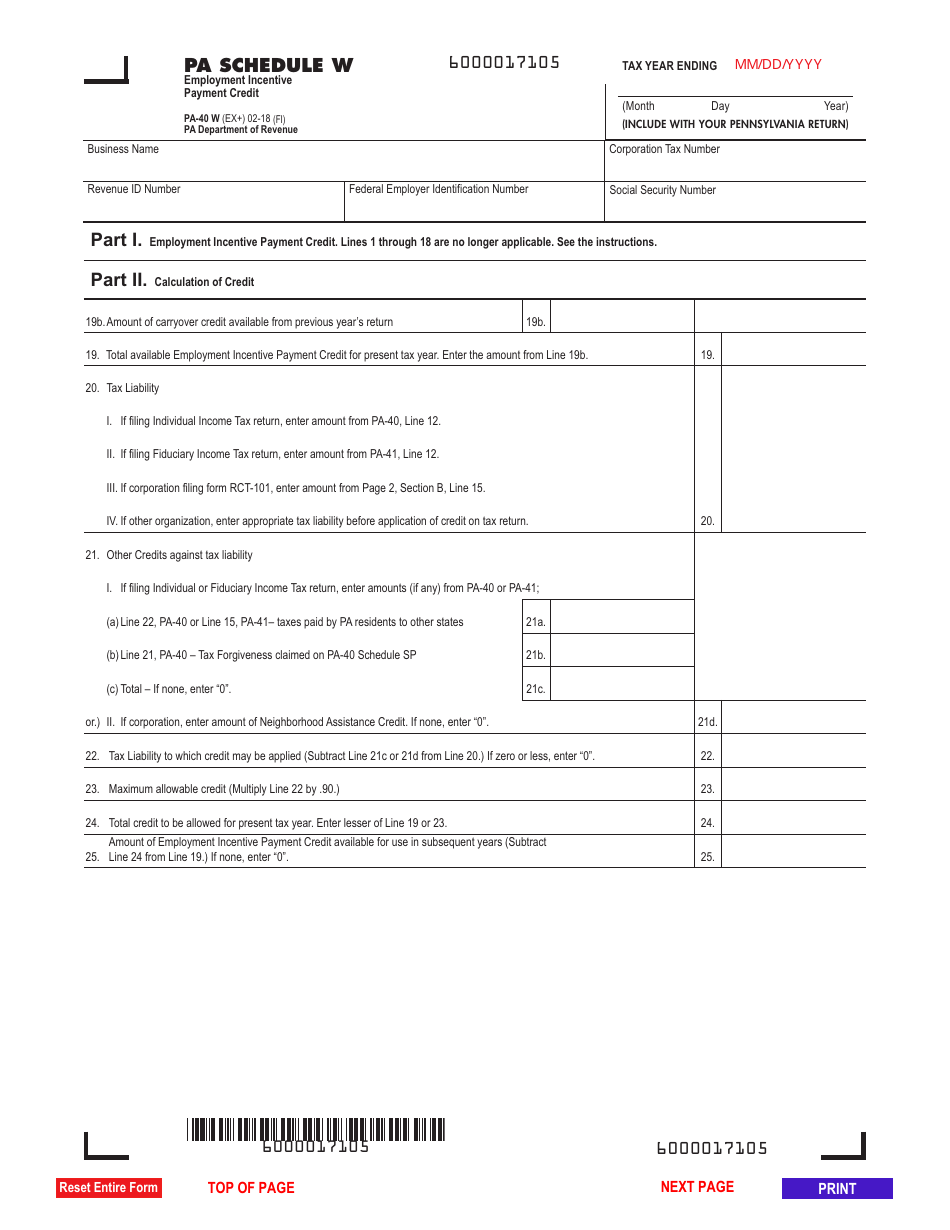

Pa 40 W Employment Incentive Payments Credit Free Download

Pa 40 W Employment Incentive Payments Credit Free Download

Form Pa 40 W Schedule W Download Fillable Pdf Or Fill Online Employment Incentive Payment Credit Pennsylvania Templateroller

Form Pa 40 W Schedule W Download Fillable Pdf Or Fill Online Employment Incentive Payment Credit Pennsylvania Templateroller

Https Www Revenue Pa Gov Formsandpublications Formsforindividuals Pit Documents 2020 2020 Pa 40sp Pdf

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Fillable Online 2000 Pa Telefile Schedule Sp Special Tax Forgiveness Credit Pa Sp Telefile Forms Publications Fax Email Print Pdffiller

Fillable Online 2000 Pa Telefile Schedule Sp Special Tax Forgiveness Credit Pa Sp Telefile Forms Publications Fax Email Print Pdffiller

Fillable Online 2000 Pa Schedule Sp Special Tax Forgiveness Credit Pa 40 Sp Forms Publications Fax Email Print Pdffiller

Fillable Online 2000 Pa Schedule Sp Special Tax Forgiveness Credit Pa 40 Sp Forms Publications Fax Email Print Pdffiller

Pa 40 2012 Pennsylvania Income Tax Return Free Download

Pa 40 2012 Pennsylvania Income Tax Return Free Download

P A 4 0 T A X F O R M P R I N T A B L E Zonealarm Results

P A 4 0 T A X F O R M P R I N T A B L E Zonealarm Results

Comments

Post a Comment