In the fourth quarter of 2020 deal volumes and values were up by 2 and 18 respectively compared with the same quarter the prior year. US outbound cross-border activity also reached 2333bn via 1476 deals representing a 2443 change when compared to the same period in 2017.

9 Charts Explaining M A Activity In 3q 2018 Pitchbook

9 Charts Explaining M A Activity In 3q 2018 Pitchbook

The slowdown of MA activity in 2018 is overcome in the first half of 2019 with the number of announced deals rising to 123.

M&a activity by year. The state of the deal MA trends 7 Divestitures Divestitures are on track to remain a critical component of MA activity in 2019. Global MA value increased by about 7 which is close to the five-year average. People People Search Services Industries Practices Regions Our Thinking Insights Publications Events Resources CFIUS FIRRMA Tool Coronavirus Crisis Management Debt Explorer FinReg Dashboard MA Explorer World in Transition About Us Our Firm Our Firm History Diversity.

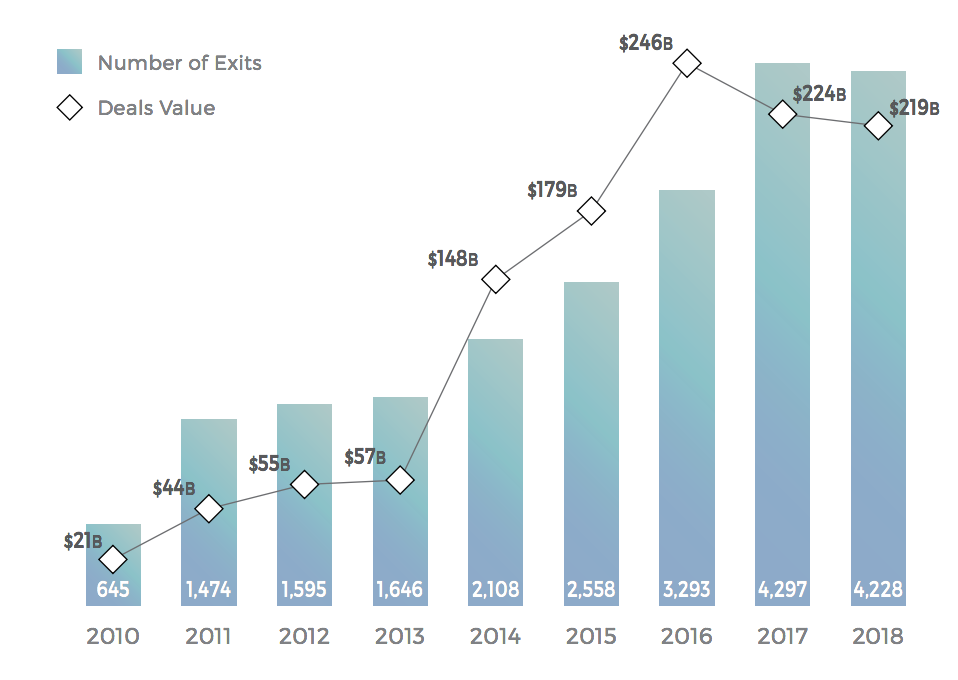

Dips can be seen in the years during and following a recession and MA activity increases in periods of economic growth. 2021 Looking Bright for MA Baird expects strong MA activity in 2021 building on the recovery experienced in the second half of 2020. For the US you find also a collection of MA reports on the Health Services sector below.

MA executives are sending clear and strong signals that dealmakingparticularly alternatives to traditional MAwill be an important lever as businesses recover and thrive in the postCOVID-19 economy. As of August 2020 there were 281 MA transactions valued at more than one billion US. Aggregate MA spending increased as well.

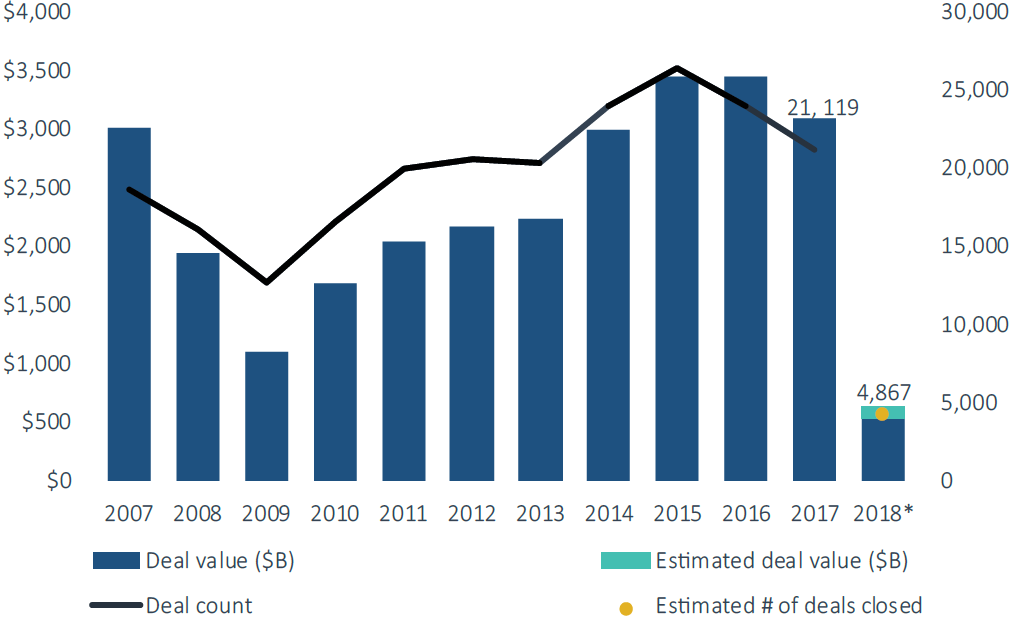

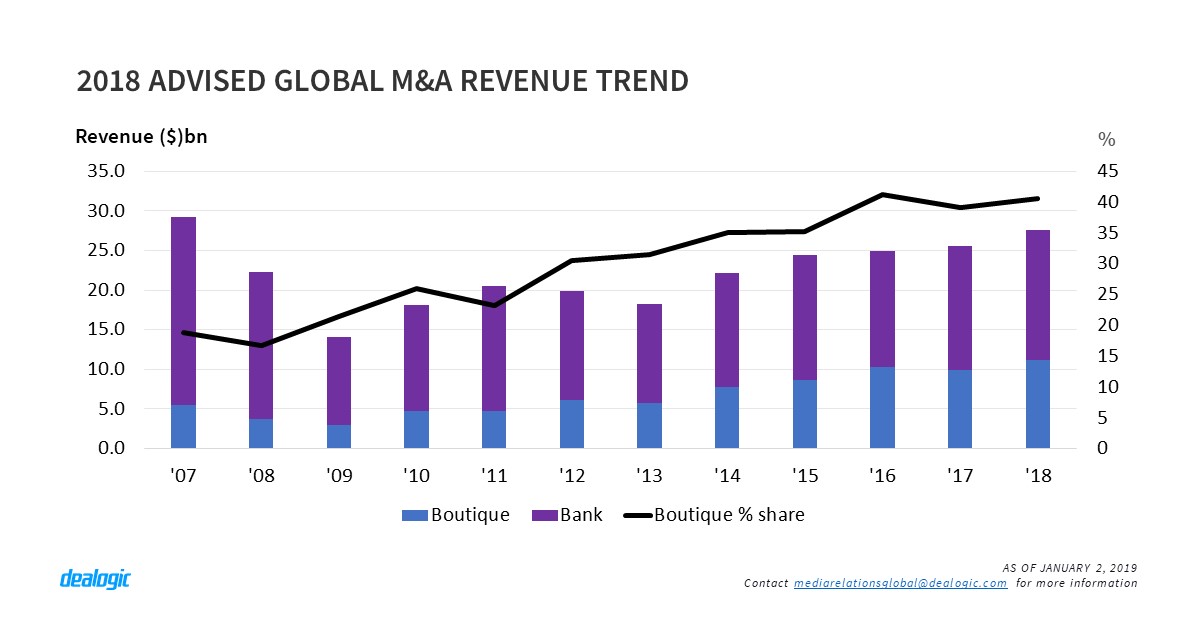

In 2018 the number of deals has decreased by 8 to about 49000 transactions. More than half of these US dealmakers 61 expect MA activity. Dollars in the United States which were completed over the past year.

MA Explorer is a tool that puts more than a decade of global MA and PE data at your fingertips. 2020 was not just a year of two halves for global private MA in terms of deal volume but also in terms of significant shifts in the tactics used by both buyers and sellers during this unprecedented period of uncertainty. In 2020 the value of global MA.

MA deal activity increased in March going up 133 with 1523 announcements compared to 1344 in February. Mergers and acquisitions MA activity surged globally in the first quarter of 2021 to a year-to-date record as companies and investment firms rushed to get ahead of. The valuation of assets remains one of the biggest challenges to MA successespecially when deal activity accelerates and competition heats up as we saw in the second half of 2020.

Second most important industry by value is the Energy Power sector. Rising Google Search Trends in the US. Deal volume declined slightly by 3 with about 35800 deals announced during the year.

The total value of announced deals in 1H2019 reaches a moderate level of about 63 billion mainly. Number Value of MA Worldwide Since 2000 more than 790000 transactions have been announced worldwide with a known value of over 57 trillion USD. Jump to comments section Print this page.

Mergermarket the leading provider of MA data and intelligence has released its 1Q21 report which revealed that the first quarter of 2021 reached USD 116tn in transactions surpassing even red-hot 2018 and 2019 making 2021 the most active annual opening on record. Over the past 3 months the sectors that saw an increase in MA deal activity relative to the same three-month period one year ago. More than 80 percent of the combined corporate and private equity respondents say they will sell units or portfolio companies in 2019 up from 70 percent a year.

Coronavirus Kobe Bryant Tax Refund. Large deal values but fewer deals have led to the highest average deal value since 2006 of. Global dealmaking activity had its strongest start to the year in four decades fuelled by a flurry of US acquisitions and Spac mergers.

We expect to see continued pick up in SPAC MA activity with around 200 SPACs possessing over 400 billion of acquisition capacity going into 2021 said Bank of. MA activity and valuations. US MA activity 2018 During 2018 US-targeted MA volume reached a total of 174tn via 7791 deals.

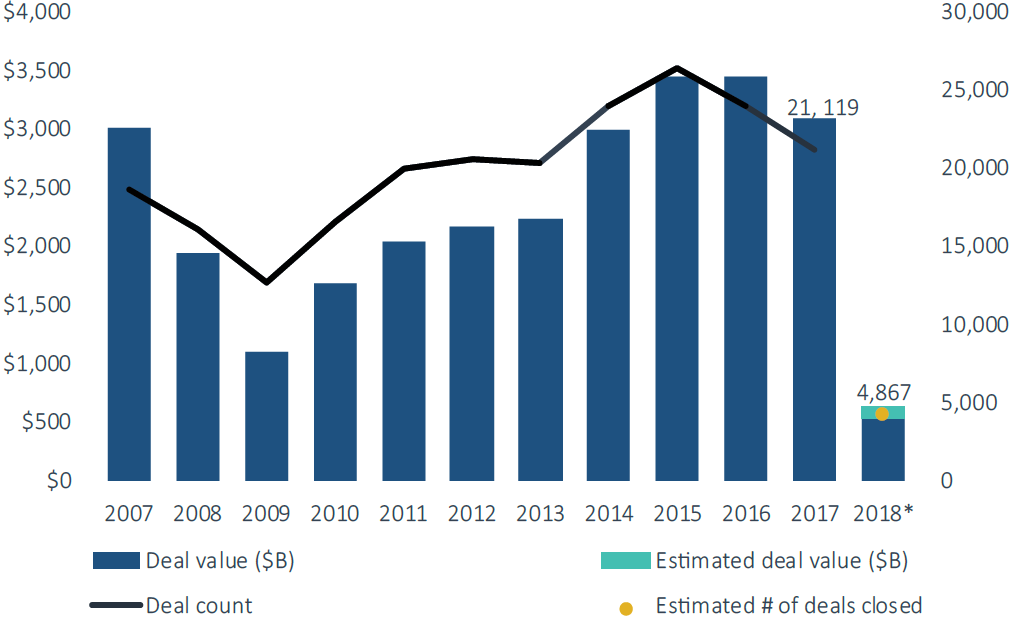

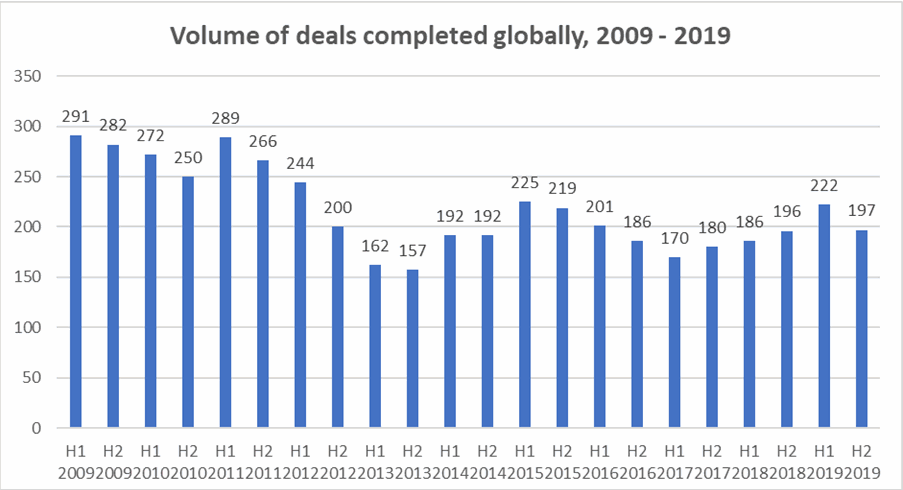

Global MA Activity Takes A Breather Taken as a whole 2018 continued the streak of good years for MA activity dating back to 2014. Across Asia-Pacific EMEA and the Americas MA. Announced MA the United States by Industries 2000-2018 The industry with the largest MA activity in terms of transaction value has been health care representing 142 of all deals with a total value of 3292 bil.

Dealmaking rebounded from June 2020 and remained strong through to year-end across all regions. The overall number of MA deals in the. January March.

Visa buys Plaid 53B Visa kicked off the fintech MA year with a bang announcing a 5. In March 27 more was spent on deals compared to February. Deloittes Future of M.

2019 Mergers Acquisitions M A Report Downturns Are A Better Time For Deal Hunting

2019 Mergers Acquisitions M A Report Downturns Are A Better Time For Deal Hunting

Tencent Leads In M A Activity By Volume In 2020 Says Globaldata Globaldata

Tencent Leads In M A Activity By Volume In 2020 Says Globaldata Globaldata

10 Charts Illustrating The State Of M A Pitchbook

10 Charts Illustrating The State Of M A Pitchbook

M A In 2020 And Trends For 2021 Morrison Foerster

M A In 2020 And Trends For 2021 Morrison Foerster

Number Of M A Deals Globally 1985 2021 Statista

Number Of M A Deals Globally 1985 2021 Statista

M A Highlights Full Year 2018 Dealogic Com

M A Highlights Full Year 2018 Dealogic Com

Re Insurance M A Surged To Four Year High In 2019 Clyde Co Reinsurance News

Re Insurance M A Surged To Four Year High In 2019 Clyde Co Reinsurance News

Value Of M A Deals Globally 1985 2020 Statista

Value Of M A Deals Globally 1985 2020 Statista

Global M A Activity Is Flat So Far In 2018 Techcrunch

Global M A Activity Is Flat So Far In 2018 Techcrunch

Mergers And Acquisitions 2015 A Record Breaking Year Successful Acquisitions

M A Highlights Full Year 2018 Dealogic Com

M A Highlights Full Year 2018 Dealogic Com

Comments

Post a Comment