Cash Out Refinance Partial IO 7 Year term Southern California. Cashout rates among participants in 401k plans for which Fidelity Investments is record keeper remain persistently high reaching 35 as of the nine months ended Sept.

Fidelity Cash Manager Tool Cash Management

Fidelity Cash Manager Tool Cash Management

More than 3 out of 4 Americans say they regret not investing sooner.

Fidelity investments cash out. You can put your cash back into the following account types at Fidelity. Deposit 50000 99999 and get 200. To learn more about the SPP and your cashout.

Purchase Amortizing 10 Year term San Diego area. Purchase Amortizing 10 Year term Chicago and suburbs. If you need to withdraw money that is already held as cash in your account all you need to do is log in and go to My accounts at the top of the page.

Although the fund seeks to preserve the value of your investment at 100 per share it cannot guarantee it will do so. Fidelity Investments and its affiliates the funds sponsor have no legal obligation to provide. Fidelity Investments offers Financial Planning and Advice Retirement Plans Wealth Management Services Trading and Brokerage services and a wide range of investment products including Mutual Funds ETFs Fixed income Bonds and CDs and much more.

Your Fidelity Account for transferring cash out. Deposit 250000 499999 and get 600. If you opt for a 401k loan or withdrawal take.

The Fidelity Cash Management Accounts uninvested cash balance is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. Cash Management Solutions Fidelity Cash Management Solutions provides an alternative for individuals seeking FDIC insurance and gives you the power to manage your cash and spending alongside your investments. In most cases loans are an option only for active employees.

An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Fidelity offers a number of services many with no fees to help you move cash in and out of your Fidelity Account SM. If you are under the age of 59 12 an IRS early withdrawal penalty may apply I still have questions where can I learn more.

Comparison based upon standard account fees. A 401k loan may be a better option than a traditional hardship withdrawal if its available. The Fund may also invest in but is not limited to certificates of deposit commercial.

If you feel down that youve missed out on any past market gains youre not alone. Its a nice automated way to build your investment portfolio and of course keeps your money at Fidelity. Services include checks funds transfer direct deposit and automatic investments.

IRA closeout fee. For Fidelity self-employed or small business 401k accounts the account holder can request a withdrawal check online through Fidelitys NetBenefits portal or he can fill out a paper withdrawal request form and mail it in. Choose Manage investments then Withdraw cash.

Explore all your options for getting cash before tapping your 401k savings. The Fund aims to maintain the value of your investment and pay you an income. Call Fidelity Investments at 1-800-343-0860 Monday through Friday 800 am.

You arent forced to put your cash back into a Fidelity account but you can. 30 according to a. Whether youre completely in cash or you just hold more of it than you think you really should here are some steps to consider to help you finally get off the sidelines.

Visit the. The amount of the bonus was based on the amount you deposited. Deposit 100000 249999 and get 300.

Fidelity allows account holders to take out money on a one-time basis or set up regularly scheduled withdrawals. The Fund will invest at least 70 in a diversified range of sterling denominated money market instruments other short-term investments and transferable securities. Fidelity Cash Management Account.

Investors have a variety of places to hold cash they dont want to invest including savings accounts money market funds deferred fixed annuities certificates of deposit CDs and short-term bonds. You could lose money by investing in a money market fund. Every employers plan has different rules for 401k withdrawals and loans so find out what your plan allows.

Guide to diversification My key hope with this. Plus earn unlimited 2 cash-back 1 on everyday purchases with the Fidelity Rewards Visa Signature Card. At a minimum there are five banks available to accept these deposits making customers eligible for nearly 1250000 of FDIC insurance.

Fidelity Investments will send a check or direct deposit the cash-out amount minus federal withholding tax. If you depend on your investments for income you should be on the more cautious side consider investing extra cash in high-quality bonds for example. If the number of available banks changes or you elect not to use andor have existing.

Other withdrawal options include rolling over to another. 495 per month Account ATM fee. The Fund is actively managed without reference to a benchmark.

For more read Viewpoints. Fidelity 529 College Savings plan. But if you have a steady income and a long way until retirement you should probably be more aggressive and consider investing some of your excess cash in stocks.

Cash Out Refinance Partial IO 10 Year term San Diego area. Up to 2500 Cash Bonus EXPIRED Fidelity Investments once offered a cash bonus if you opened an account and transferred new funds. Watch EFT video Learn how to set up EFT Access your account online View plan balances and trade anytime anywhere through NetBenefits.

Purchase and Cash Out Refinance Amortizing 10 Year term Greater Seattle. Your Fidelity investment professional can work with you to develop a plan to help you invest your cash for the long term. Let go of the past.

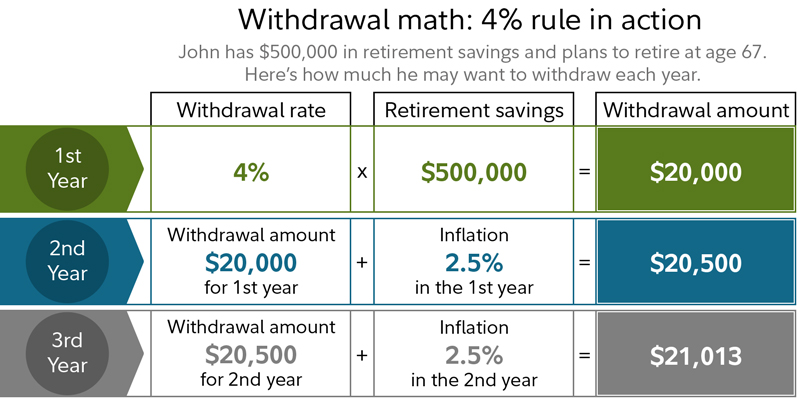

How Long Will My Savings Last Fidelity

How Long Will My Savings Last Fidelity

Fidelity Cash Management Account Review 2021

Fidelity Cash Management Account Review 2021

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

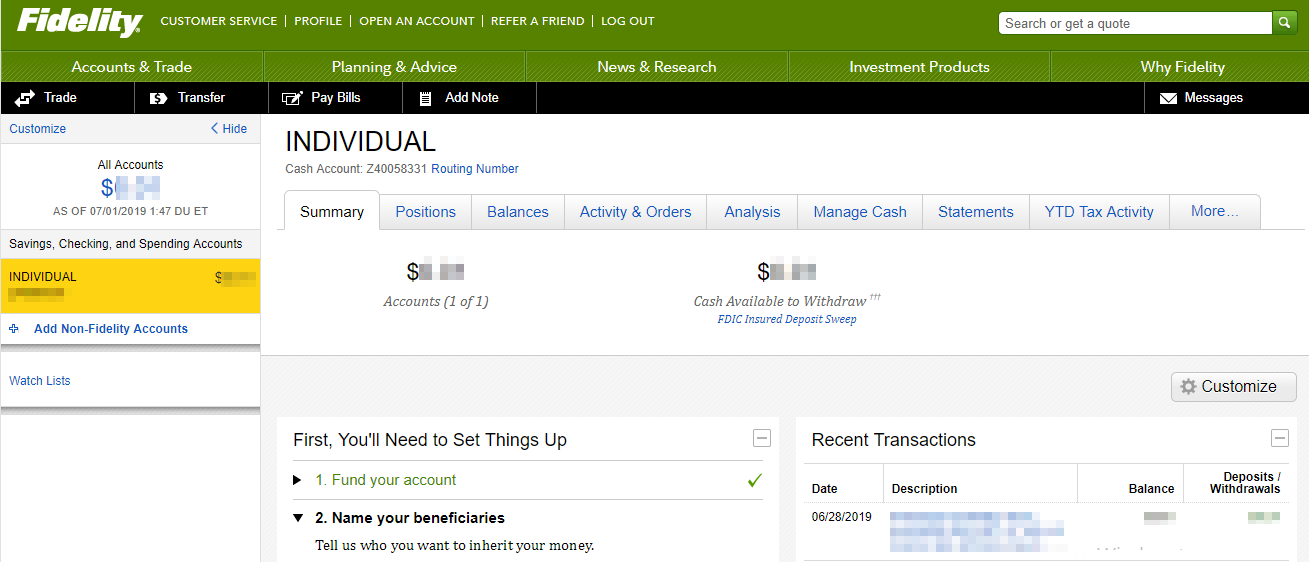

Fidelity Withdraw Money Account Terms To Transfer Funds Out 2021

Fidelity Withdraw Money Account Terms To Transfer Funds Out 2021

Fidelity Withdraw Money Account Terms To Transfer Funds Out 2021

Fidelity Withdraw Money Account Terms To Transfer Funds Out 2021

Fidelity Cash Management Account Review Worth It

Full View All Your Online Financial Information In One Place Fidelity

Full View All Your Online Financial Information In One Place Fidelity

Https Www Fidelity Com Bin Public 060 Www Fidelity Com Documents Earnings Automatic Withdrawal Plan Nonret Pdf

Trading Faqs About Your Trading Account Fidelity

Trading Faqs About Your Trading Account Fidelity

Fidelity Investments Review 2021 Pros Cons And How It Compares Nerdwallet

Fidelity Investments Review 2021 Pros Cons And How It Compares Nerdwallet

401k Rollover Options Fidelity

401k Rollover Options Fidelity

Fidelity Average 401 K Balance Nearly Doubles Since Downturn Business Wire

Fidelity Average 401 K Balance Nearly Doubles Since Downturn Business Wire

Fidelity Debit Card Free Atm Debit Card Fidelity

Fidelity Debit Card Free Atm Debit Card Fidelity

/Fidelity_Investments_Recirc-64c268bfd0824442ab46e820805d5474.jpg)

Comments

Post a Comment