I do also have a REIT fund mostly because of its relatively low correlation with the rest of stocks and bonds. And if my property taxes get so high I cant afford.

5 Best Index Funds In May 2021 Bankrate

5 Best Index Funds In May 2021 Bankrate

That works out to be about four.

How many index funds should i own. How many mutual funds investors should have depends on the type of investments in the fund owning shares in one fund can be enough if properly diversified. You should therefore only keep as many funds in your portfolio as you are comfortable monitoring For example if you hold ten twenty or more different funds youll need to keep a close eye on the changing value of all these investments to ensure your asset. Index funds are popular because they often have low fees and offer a variety of stocks and bonds.

Bogle says that taxes fees and trading costs eat away one to two percentage points a year of the. So having a house just keeps me from having to pay rent. A four-fund allocation could include a domestic stock fund a domestic bond fund an international stock fund and an international bond fund.

I do own my house which is nearly 12 of my total net worth but I also think of it differently. Its sort of like a fund that pays whatever current rents are minus taxes and repairs. Buy index funds in your taxable account as well as in your 401k.

If the index fund is already diversified an attempt to diversify more is not needed and will just make your portfolio harder to understand. A well-diversified portfolio should hold between 10-20 funds. If the index fund youre planning to invest to seems global do remember to check whether being global means it invests a large enough percentage to emerging markets.

You can certainly do it with one and that would be something like the Vanguard Balanced Index. For popular indexes like the SP 500 you might have a dozen or more choices all tracking the same index. Once youve chosen an index you can generally find at least one index fund that tracks it.

If you know what youre doing and have the time that shouldnt be an issue to manage. Increasingly popular two-fund portfolios with a stock fund and a bond fund may allow for increased diversification. Whats too many and whats too few.

Whether you own too many or too few funds in a portfolio the problem is the same. Generally it doesnt make sense to invest into two index funds investing to the same. As you get more experienced and more comfortable making your own investment decisions then the number of funds is likely to grow.

For example robo-advisors online investment firms that create automated portfolios for investors typically use at least eight to 10 ETFs to diversify each clients account an analysis. Investing can be tedious time-consuming and utterly confusing. Stock market index fund and a total US.

For example you might put 60 of your money in stock index. Bond market index fund -- you would have exposure to all. One index fund can hold a few hundred or even a few thousand companies so investors are fairly diversified when they choose an index.

By investing in several index funds tracking different indexes you can built a portfolio that matches your desired asset allocation. Index funds are good for the short term. These index funds are.

Vanguard Total Stock Market Index Fund VTSAX is a well-known mutual fund that attempts to track the entire US stock market. If the results. If youre using broad index funds such as a total stock market or total bond market fund youll need only one for each asset class.

The key difference in buying individual stocks vs a broad index fund like VTSAX for me is that Im pinning my hopes on the entire US market instead of an individual stock. Because they track an index passively they dont require the overhead and management that other funds do. How many funds should they own as an individual.

It operates with incredibly low fees and has a very similar sister ETF with the tracker VTI. This is particularly important for actively managed funds which cost more than index funds. Some index funds could experience less volatility than others and some are designed for shorter holding periods.

For example with just two funds -- a total US. Four funds. But dont invest in an index fund unless.

And if youre investing in individual stocks I recommend you choose anywhere from 10 to 30 different stocks.

How To Invest In Index Funds A Beginner S Guide

How To Invest In Index Funds A Beginner S Guide

/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png) Investing In Index Funds For Beginners

Investing In Index Funds For Beginners

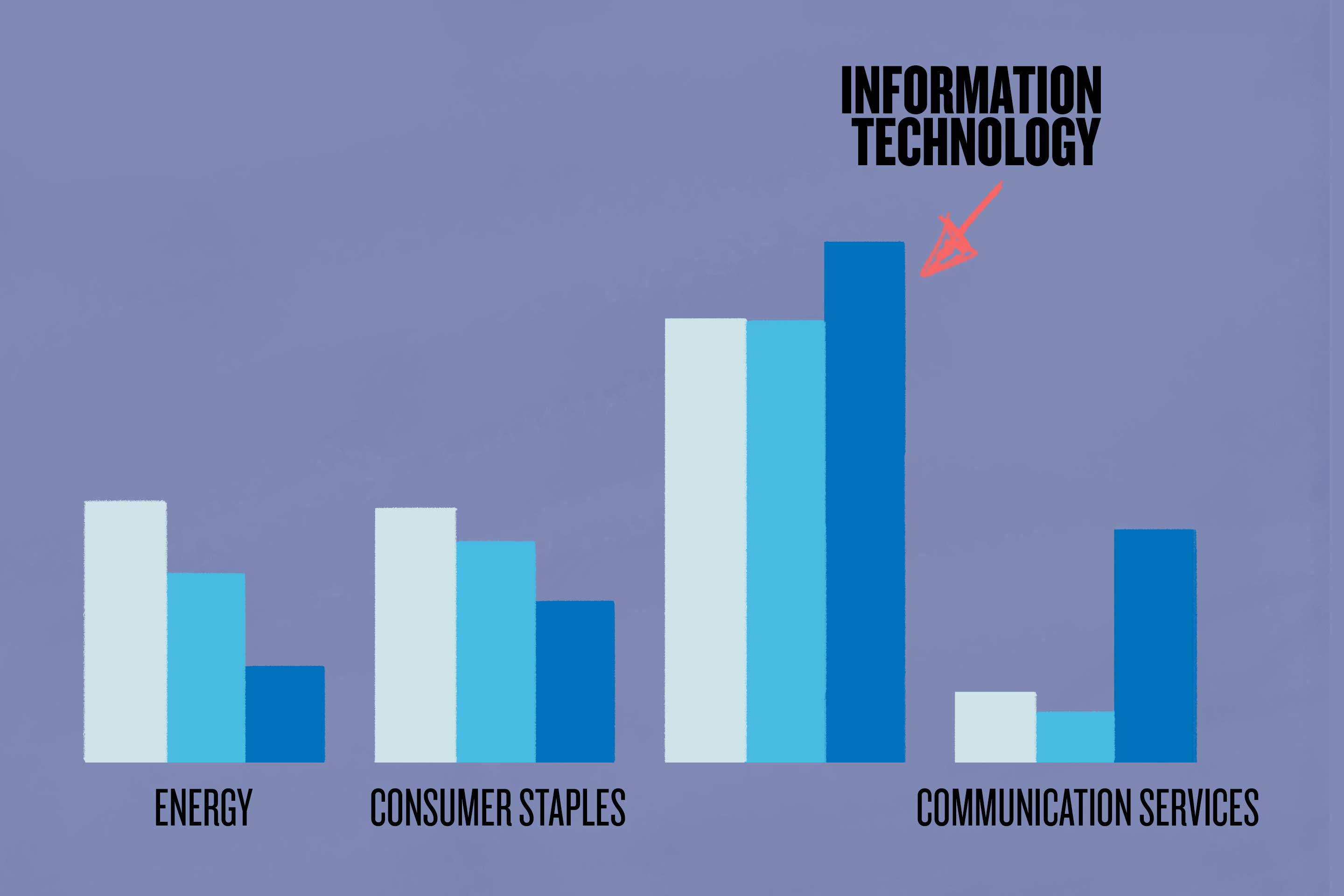

Index Funds Mean A Big Bet On Tech Stocks Money

Index Funds Mean A Big Bet On Tech Stocks Money

Individual Stocks Vs Index Funds Why I Choose Both Retire Before Dad

Individual Stocks Vs Index Funds Why I Choose Both Retire Before Dad

/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png) Investing In Index Funds For Beginners

Investing In Index Funds For Beginners

Individual Stocks Vs Index Funds Why I Choose Both Retire Before Dad

Individual Stocks Vs Index Funds Why I Choose Both Retire Before Dad

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-02-051df666ccc24f06a8d2d8a09b8f4c24.jpg) The Hidden Differences Between Index Funds

The Hidden Differences Between Index Funds

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-04-e87a6f8de5e14ab1a4a15f687bdb3ecf.jpg) The Hidden Differences Between Index Funds

The Hidden Differences Between Index Funds

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg) The Hidden Differences Between Index Funds

The Hidden Differences Between Index Funds

How Many Index Funds Should An Investor Own

How Many Index Funds Should An Investor Own

How Many Funds Should I Have Nerdwallet

How Many Funds Should I Have Nerdwallet

/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg) The Hidden Differences Between Index Funds

The Hidden Differences Between Index Funds

What Is An Index Fund And Why Should I Invest In One Clark Howard

What Is An Index Fund And Why Should I Invest In One Clark Howard

:max_bytes(150000):strip_icc()/investing-terms-you-should-know-356338_FINAL-5c5af82146e0fb0001be7b2c.png) Investing In Index Funds For Beginners

Investing In Index Funds For Beginners

Comments

Post a Comment