1119 M 3 Year Net Flows. ROBO NAV 499 026 899 7452 1822 2163 --.

Robotics And Automation The New Etf And Where To Invest Nysearca Robo Seeking Alpha

Robotics And Automation The New Etf And Where To Invest Nysearca Robo Seeking Alpha

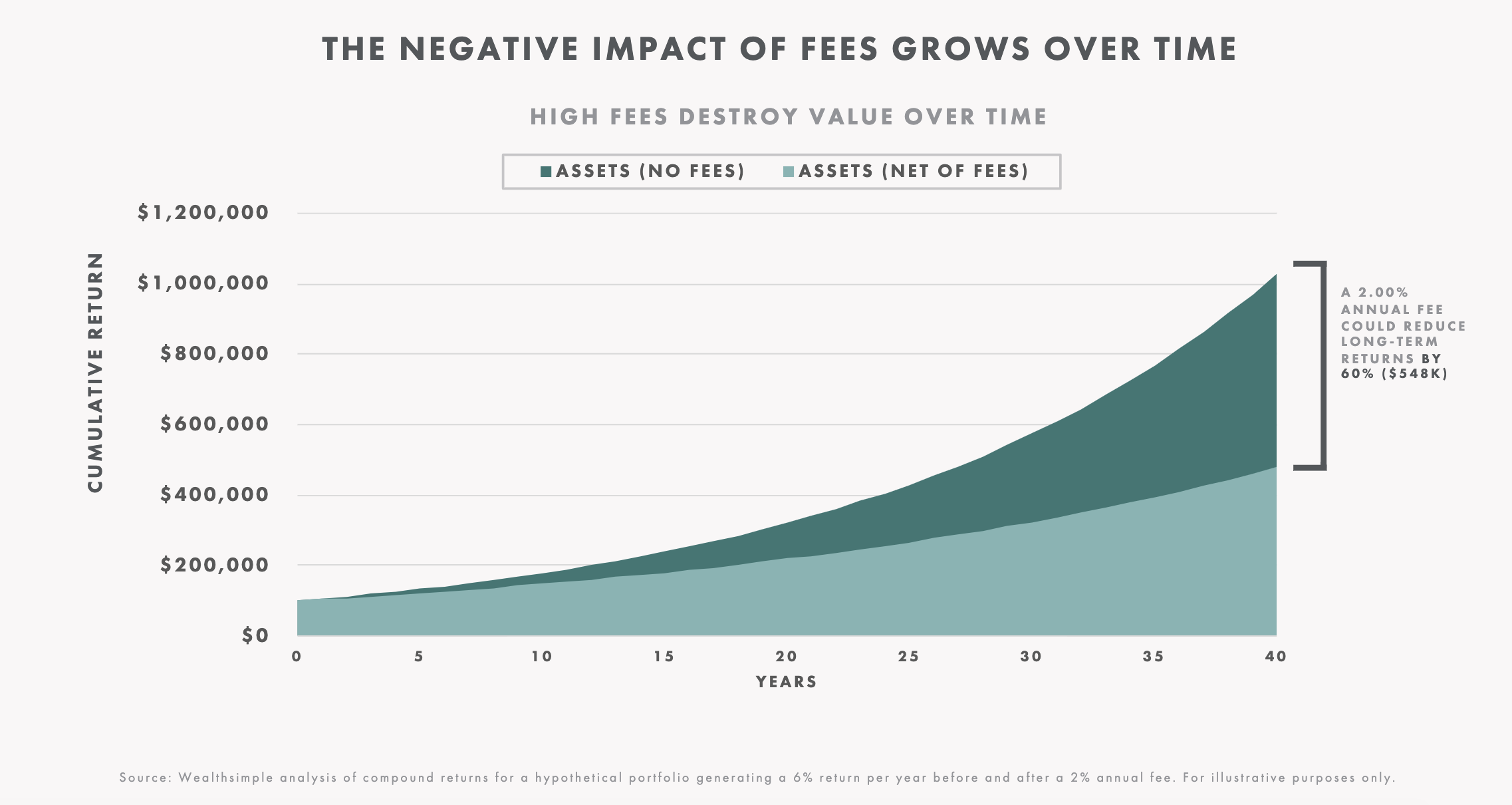

These are like management fees only theyre paid not to the robo-advisor but to the investments the robo-advisor uses.

Robo etf fees. ROBO 506 -039 907 7603 1837 2145 --. All robo-advisor management fees are listed as a percentage of assets under management AUM. -5044 M 6 Month Net Flows.

14022 M 1 Year Net Flows. Theyre 024 to 028 compared to regular index ETFs that charge an average 010. In general the range of fees charged by the top Robo Advisors is actually quite wide no matter which type of fee structure they employ.

And the ETF fund fees are slightly higher. Read the prospectus carefully before investing. ROBO aims to provide investors with a return that before fees and expenses tracks the performance of the ROBO Global Robotics and Automation Index.

The first 10000 is managed for free which is great news for smaller-scale or beginning investors. The second way is to invest via exchange traded funds ETFs. Account Management Fee.

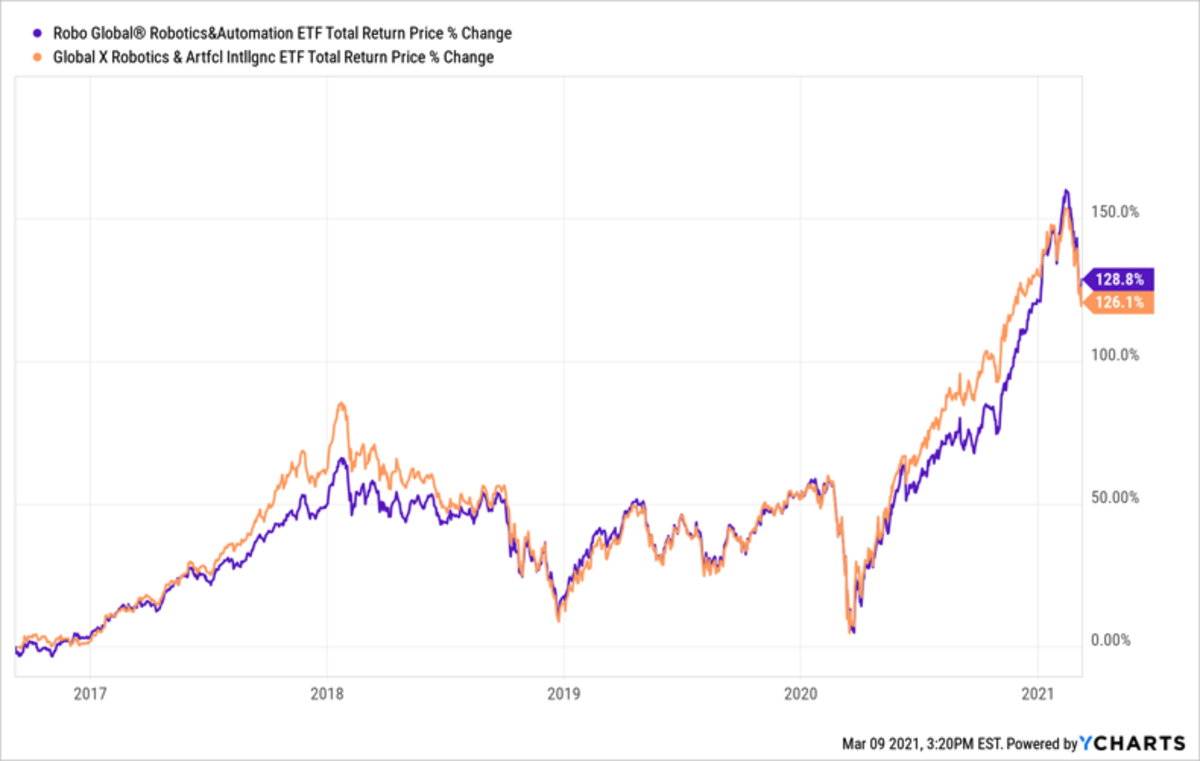

11 B Custom Range Net Flows. So if you invest 1000 and the fee is 025 then you will pay 250 per year to have your money managed. However many robo-advisors only charge an advisory fee and use the money gained from that fee to pay for any trades and maintenance needed on an account.

Robo Global Robotics and Automation Index 505 045 932 7593 1886 2248 --. The adjacent table gives investors an individual Realtime Rating for ROBO on several. For robo advisors that levy a set fee it can typically range from 10 or less as a one-time payment to a monthly charge of anything between 1 and 300 depending on the size of your investor account.

Some robo-advisors may also charge for trades such as buying or selling an ETF add-on services or account maintenance. Its MER fees are lower than. These are both the companies creating the technology enabling truly intelligent systems that can sense process and act and those apply the technologies to deliver robotics and automation-enabled products to businesses and consumers.

Your portfolio is invested in stocks and bonds but also real estate and municipal bond funds for added diversification. FUM fee and spread data is updated monthly with a delay. If your primary concern is rock-bottom fees there are several robo-advisors with broadly diversified low-fee ETF portfolios.

005-010 for their Core Portfolios 013-019 for their Impact Portfolios Account Minimum. -1565 M 1 Month Net Flows. No tax-loss harvesting fewer investment options than other robo-advisors Pros.

Exchanges that are currently tracked by ETF Database including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported. 5 Day Net Flows. Top 4 ETFs For Investing In Robotics.

Refer to the ETFs PDS and the ASX website for up-to-date information. ETF companies charge the Management Expense Ratio MER fees and they apply for all robo-advisors. Regardless of which robo-advisor you use you pay these kinds of ETF fees in addition to the robo-advisory fees.

-88186 M 5 Year Net Flows. ROBO uses a full-replication strategy to track the index meaning it holds all the shares that make up. 025 ETF Expense Ratio.

Nest Wealth utilizes only low-cost ETFs that charge an average MER of 013 for balanced portfolios. Robo-Advisor vs Human Financial Advisor Which is Best. On top of advisory fees some robo-advisors charge other fees.

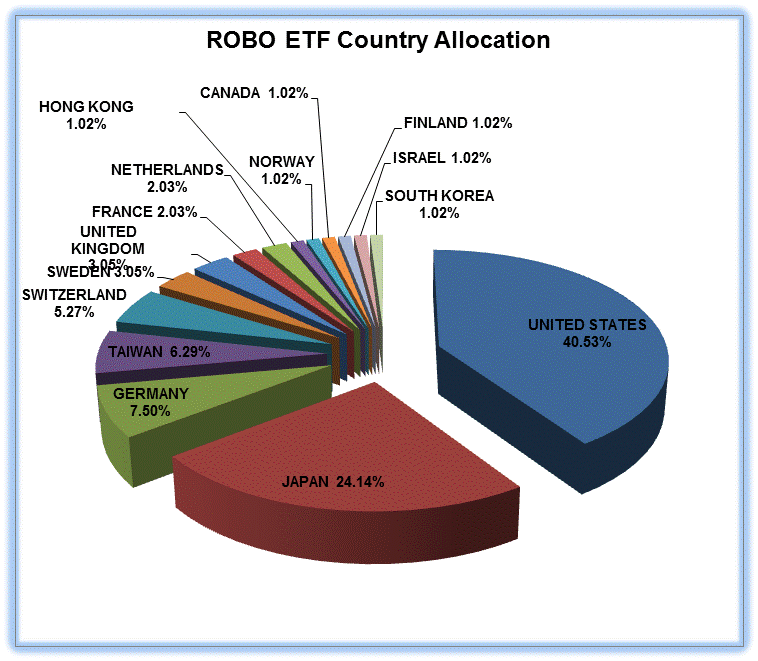

ROBO Global Robotics and Automation Index ETF ROBO 1265 iShares Robotics and Artificial Intelligence ETF IRBO 175 First Trust Nasdaq Artificial Intelligence and Robotics ETF ROBT 116 Direxion Robotics Artificial Intelligence and Automation ETF UBOT 48. The ROBO Global Robotics Automation ETF ROBO is a portfolio of global robotics and automation stocks. The following table includes certain tax information for all Robotics ETFs listed on US.

ETF share prices are updated using end of day data from the ASX. ETFs provide a cost-efficient transparent and. Carefully consider the Funds investment objectives risk factors charges and expenses before investing.

Geared towards women investors low account management fees Ellevest is best for those who would like investing done with a female touch. The management fee of 025 is well below the 100 150 charged by traditional money managers. 1 B 10 Year Net Flows.

-2197 M 3 Month Net Flows. Mutual funds index funds and exchange-traded funds. Some robo-advisors claim rebalancing and tax-loss harvesting in.

Its how the ETF pays its fund managers and covers trading expenses.

Robo Advisor Fees Comparison Chart Financial Samurai

Robo Advisor Fees Comparison Chart Financial Samurai

Robo Summary Robo Global Robotics Automation Index Etf

Robo Summary Robo Global Robotics Automation Index Etf

5 Biggest One Etf Hit Wonders Etf Com

5 Biggest One Etf Hit Wonders Etf Com

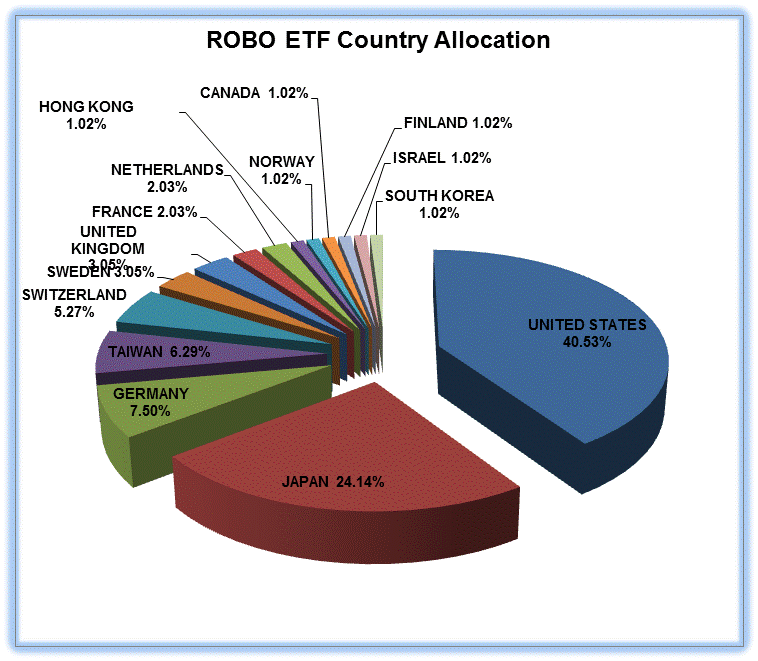

Botz Vs Robo The Best Robotics Artificial Intelligence Etf For 2021 Etf Focus On Thestreet Etf Research And Trade Ideas

Botz Vs Robo The Best Robotics Artificial Intelligence Etf For 2021 Etf Focus On Thestreet Etf Research And Trade Ideas

War Of The Robotic Etfs Etf Com

War Of The Robotic Etfs Etf Com

Enough With Robo Advisors Already Chris Reining

Enough With Robo Advisors Already Chris Reining

Two Etfs For Artificial Intelligence And Robotics Nanalyze

Two Etfs For Artificial Intelligence And Robotics Nanalyze

Robo Advisor Vs Financial Advisor

Robo Advisor Vs Financial Advisor

Vanguard Personal Advisor Services Robo Investing Performance Review 2020

Robo Global Artificial Intelligence Etf Thnq Launches On Nyse Business Wire

Robo Global Artificial Intelligence Etf Thnq Launches On Nyse Business Wire

Robotics And Automation Etfs Programmed For Further Gains

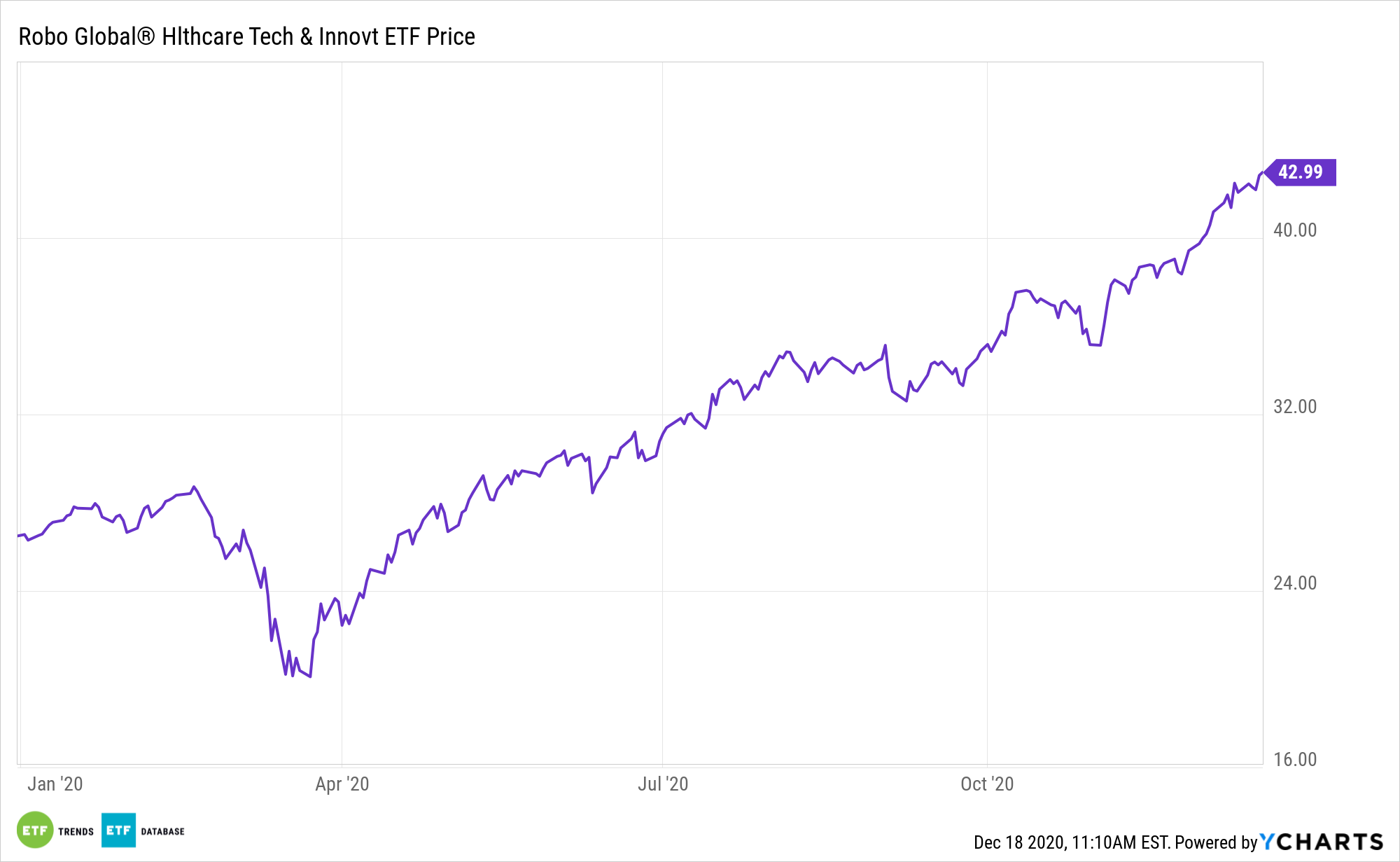

Robo Global S Htec Hits 100 Million Aum Boasts 59 Annual Gain

Robo Global S Htec Hits 100 Million Aum Boasts 59 Annual Gain

What S A Robo Advisor Wealthsimple

What S A Robo Advisor Wealthsimple

Comments

Post a Comment