Upgrade is a good alternative to LendingClub for borrowers with fair to bad credit in addition to those that need a smaller loan since Upgrades minimum loan is smaller than most other lenders. Another one of the excellent Lending Club competitors is SoFi.

Lendingclub Review My Experience Using Lendingclub

Lendingclub Review My Experience Using Lendingclub

Most also offer business lines of credit.

Like lending club. Loans in which you receive a lump sum of money and repay in fixed incremental installments. The company was established in 2011 and has become one of the top funders in the alternative lending space. And it can take as long as five days to get your funds.

Like Lending Club the following lenders offer installment loans. Peer-to-peer lenders sometimes called P2P lending remove the middleman between lenders and borrowers. It offers slightly higher loans than LendingClub with a slightly lower starting interest rate 694.

But its origination fees are higher than even some P2P lenders charge. Our LC TM Marketplace Platform has helped more than 3 million members get over 60 billion in personal loans so they can save money pay down debt and take control of their financial future. Peer-to-peer lending sites like LoanStart and Prosper have changed both the way people borrow money and invest it.

Borrowers can use the website to obtain loans between 1000 and 40000 from other users. The industry is currently dominated by companies like Lending Club Prosper Upstart Funding Circle and Bondora GoGrow. This lending site lets you borrow money for many.

Based in California Lending Club is an online peer-to-peer lending and borrowing platform the largest in the world. Plus you can check your interest rates with Upgrade without impacting your credit score. Similar companies and competitors in the areas of Fintech Consumer Technology Consumer Digital Personal finance Software Big Data and more.

Lending Club ist ein 2006 gegründetes US-amerikanisches Unternehmen mit Sitz in San Francisco. As I mentioned LendingClub plans to essentially transform its business from a peer-to-peer lending platform to something that more closely resembles an online bank. While most banks use.

8 Peer to Peer Loan Sites Like Lending Club SoFi. Lending Clubs awards include being named to the Inc. Investors invest in fractional loans similar to what LendingClub offered with a 10 minimum per loan.

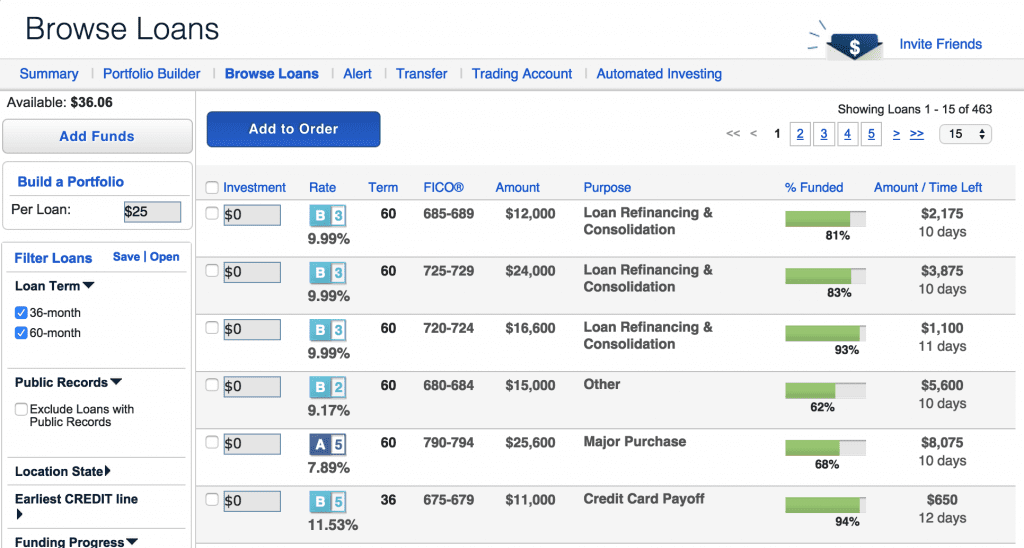

For an entity like LendingClub this has the impact of front loading expenses as the retained loan balance grows. Investors can browse loan listings and select loans to invest in and make money on the interest. Das Unternehmen vermittelt Peer-to-Peer-Kredite über das Internet und war 2013 die größte peer-to-peer-lending Plattform der Welt.

LendingClub is Americas largest lending marketplace connecting borrowers with investors since 2007. Upstart is one of the ideal places to get a loan online if you have a low credit score. 500 in 2014 and a CNBC Disruptor 50 for the second year in a row one of Forbes Americas Most Promising Companies three years in a row one of The Worlds 10 Most Innovative Companies in Finance by Fast Company in 2013 and a 2012 World Economic Forum Technology Pioneer.

In recent years the peer to peer lending industry has seen impressive growth. Some are easier to qualify for than Lending Club but might have higher rates whereas others are harder to qualify for but offer lower rates. Late fees are.

Growth of peer to peer lending business. It involves consumer investors giving loans to borrowers through online platforms that connect borrowers and lenders. According to studies the industry is expected to have a CAGR of 25 until 2025 when it will reach more than 850 billion.

The first P2P platform in the US Prosper allows you to invest in a diverse range of personal loans just like LendingClub. Lending Club allows the added benefit of being able to download the spreadsheet of all available loans on the platform and then you can do analysis on these loans in Excel. The average loan size last year was 202000 with an average of 710 investors per loan.

In their 2020 Year in Review they shared that Groundfloor investors received an average rate of return of 1042. Maximumminimum amount you can borrow. Lending Club recently announced a major change to its investment model in 2021.

Prosper doesnt allow a download but it does have superior filtering capability on their platform. This article will be updated as news unfolds. Companies like Lending Club.

The CFO does a good job of explaining this on the Q4 earnings call. Origination fees range from 1 to 5 for a 3-year term and from 2 to 5 for a 5-year term. Just like Lending club it offers estimated quotes right after a quick and easy online application.

Lending Club What Is Peer To Peer Lending Infographic Consumers Research

Lending Club What Is Peer To Peer Lending Infographic Consumers Research

Lending Club Investor Review Invest Like A Bank Earn 5 9

Lending Club Investor Review Invest Like A Bank Earn 5 9

How Peerstreet Compares To The Model Of Lending Club

How Peerstreet Compares To The Model Of Lending Club

7 Sites Like Lendingclub With Lower Rates Fees Finder Com

7 Sites Like Lendingclub With Lower Rates Fees Finder Com

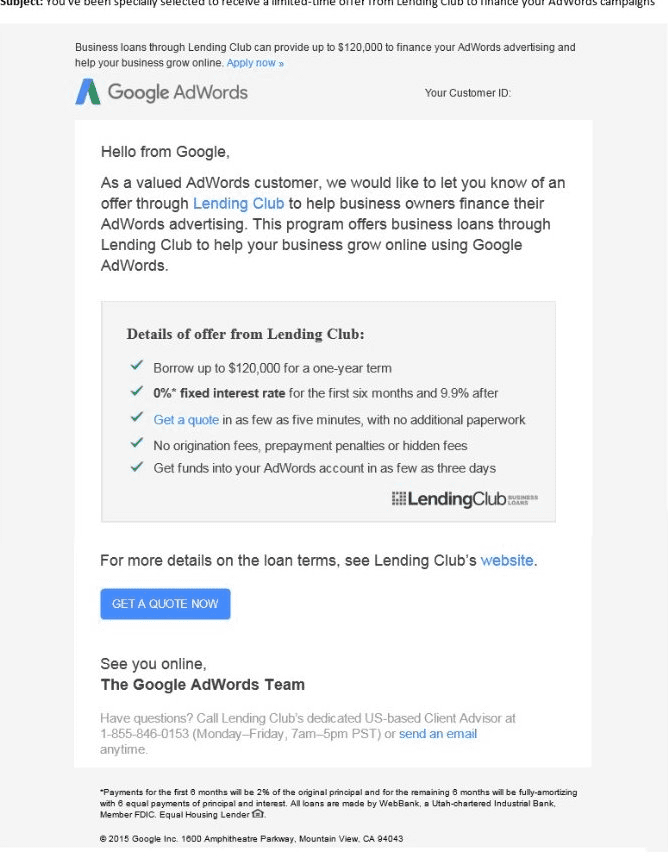

Lending Club Running Test To Fund Google Adwords Customers Lend Academy

Lending Club Running Test To Fund Google Adwords Customers Lend Academy

Lending Club Review 2021 Is It A Good Investment For You

Lending Club Review 2021 Is It A Good Investment For You

Lending Club Review For New Investors Lend Academy

Lending Club Review For New Investors Lend Academy

Lendingclub Review My Experience Using Lendingclub

Lendingclub Review My Experience Using Lendingclub

Lending Club Reviews For Investors And Borrowers Is It Right For You

Lending Club Reviews For Investors And Borrowers Is It Right For You

Lending Club Reviews For Investors And Borrowers Is It Right For You

Lending Club Reviews For Investors And Borrowers Is It Right For You

Lending Club Vs Prosper 2021 Which Is Better For Investing

Lending Club Vs Prosper 2021 Which Is Better For Investing

Lending Club Review 2019 Peer To Peer Lending Fees Pros Cons

Lending Club Review 2019 Peer To Peer Lending Fees Pros Cons

Lending Club Vector Logo Logowik Com

Lending Club Vector Logo Logowik Com

Comments

Post a Comment