- However bitcoin blocks are not produced on a fixed schedule. 020 a year for the first 1 million and no service fee for investments over 1 million.

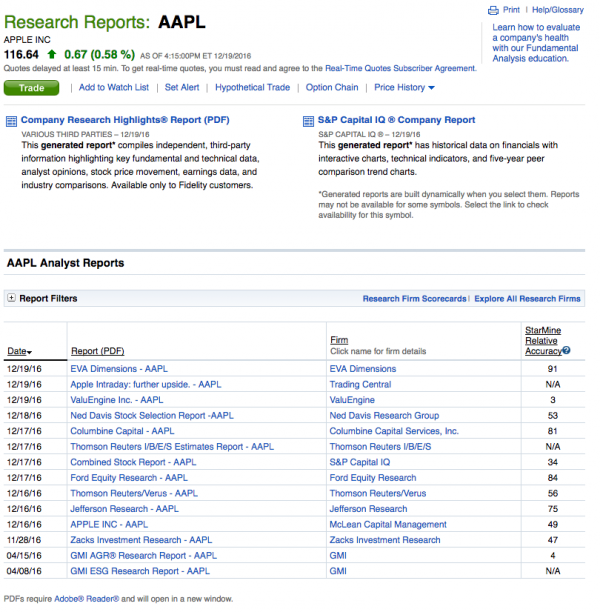

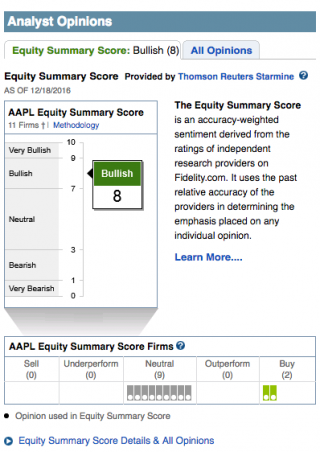

Fidelity Go Review Smartasset Com

Fidelity Go Review Smartasset Com

Fidelitys pricing move offers choice which is likely to mollify most advisors says Kitces.

How much does fidelity charge. Additional fees and minimums apply for non-dollar bond. A regular savings Fidelity Investment ISA can be started for as little as 25 per month. Fidelity Go doesnt charge an annual fee until you invest 10000.

Bitcoin transaction fees have been inching higher across the entire world over the past month and weve increased our fees in line with this to ensure that your transactions are picked up by miners for processing. However if the fund is sold within 60 days of purchase a 4995 short-term redemption fee is charged. Rates are for US.

As you review this inf ormation please keep in mind that fees are subject to change and that certain Plan administrative fees may not be. You dont pay a sales charge if you invest in our fee-based series. This is called a deferred sales charge.

Despite Fidelitys mutual fund transaction fee the. A summary of the types of sales charges are as follows. Fidelity offers over 10000 mutual funds many of which carry no load and no transaction fee.

Fidelity notes Your bank may charge a fee for sendingreceiving a wire⁴ These flat fees can range from 10-50 and may be levied by up to 4 banks on top of Fidelitys fees. A pre-screened group of mutual funds called Fund Picks From Fidelity is available to all the brokers clients. A 250 maximum applies to all trades reduced to a 50 maximum for bonds maturing in one year or less.

The same service fee is charged across all of your investments. Treasury purchases traded with a Fidelity representative a flat charge of 1995 per trade applies. Alternatively you can choose to wait until you redeem your funds and pay a percentage of their original cost to us at that time.

You wont notice this as a direct transaction since it gets taken from the funds assets directly but this is lowering the return or worsening the loss on the fund. Average fees for small plans under 100 million in assets were between 15 and 2 with plenty of plans with less than 50 million in assets paying more than 2 a year in fees. Through Fidelity investors have access to over 13000 different mutual funds.

Based on the information and direction Fidelity had on file at the time this document was prepared the following Plan administrative fee may be deducted from Plan accounts. The firms charge for trading stocks and regular ETFs is 0. Its the only robo-advisor Ive reviewed with no underlying expense ratios so the numbers you just read are all-in costs.

Via a Fidelity ISA you can invest in a range of funds unit trusts and ETFs. Regular mutual fund trades are 4995 per buy 0 per sale. Ally Invest charges an even lower 995 for no-load funds.

Fidelity uses Fidelity uses the Additional Assessment to pay certain charges imposed on Fidelity. Placing the trade over the phone is 5 and placing the trade with a living breathing broker is a somewhat pricey 3295. Fidelity Investing In Bitcoin How Much Does Coinbase.

Then its 3 per month until you invest 50000 at which time the price levels out at 035 annually. The firm previously charged 495 for trades. 001 to 003 per 1000 of principal is charged by Fidelity.

This means the maximum fee you will ever pay for all of your personal accounts is 2000 a year. If it has a 1 ER and you have 1000 invested in it then it costs you 10 for the year a very simplified example. The advisor went on to explain that Schwab is repricing them and charging six basis points for ABP asset-based pricing for transaction-fee mutual funds and 10 per account fee across the board.

For more details please visit our main fees and charges page. Fidelity boasts 246 trillion in assets that it manages for clients and has 218 million accounts with total assets of 68 trillion. This is called an initial sales charge and the amount you pay is negotiable with your advisor.

Fidelitys charge for mutual fund transactions is a little steep compared to some of its rivals. What Are Fidelitys Financial Advisor Options. Minimum to open most Fidelity accounts is somewhat high 2500.

Minimum markup or markdown of 1995 applies if traded with a Fidelity representative. Fidelity offers a clear and simple approach to fund charges with typical low-cost service fees of 035 and ongoing charges from 006. How Much Does Bitcoin Charge Per Transaction.

ETrade clients for instance pay just 1999 for non-NTF mutual funds. For No Transaction Fee NTF funds there is no charge to buy or sell. Fidelity charges 5 for each acquisition of additional shares of a pre-existing mutual fund holding that is signed up for automatic purchases.

Is Fidelity Good For Beginners Is It A Good Firm To Invest With

Is Fidelity Good For Beginners Is It A Good Firm To Invest With

Fidelity Investments Review 2021 Pros Cons And How It Compares Nerdwallet

Fidelity Investments Review 2021 Pros Cons And How It Compares Nerdwallet

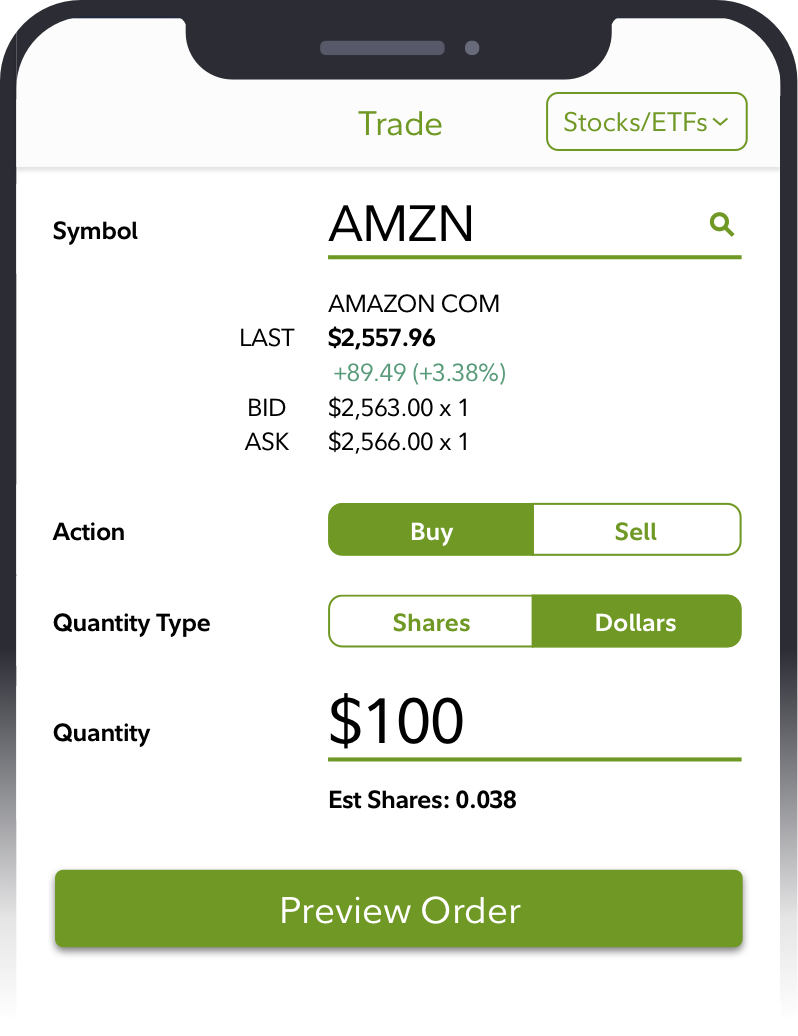

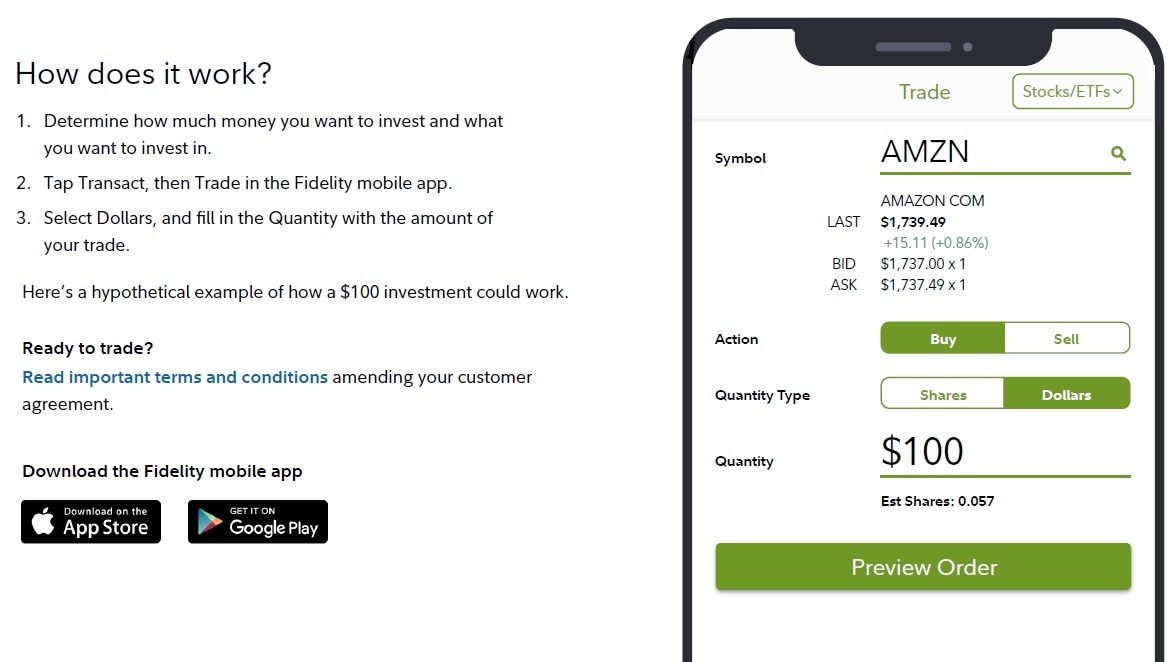

Stocks By The Slice Fractional Shares With Dollar Based Investing Fidelity

Stocks By The Slice Fractional Shares With Dollar Based Investing Fidelity

Fidelity Investments Review 2021 Pros Cons And How It Compares Nerdwallet

Fidelity Investments Review 2021 Pros Cons And How It Compares Nerdwallet

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

2021 Fidelity Investments Review Fees Pros And Cons Benzinga

2021 Fidelity Investments Review Fees Pros And Cons Benzinga

Fidelity Simplifies Investing Again With Launch Of Real Time Fractional Shares Trading For Stocks And Etfs Business Wire

Fidelity Simplifies Investing Again With Launch Of Real Time Fractional Shares Trading For Stocks And Etfs Business Wire

/Fidelityvs.Robinhood-5c61f1a6c9e77c00016626a5.png) Fidelity Investments Vs Robinhood

Fidelity Investments Vs Robinhood

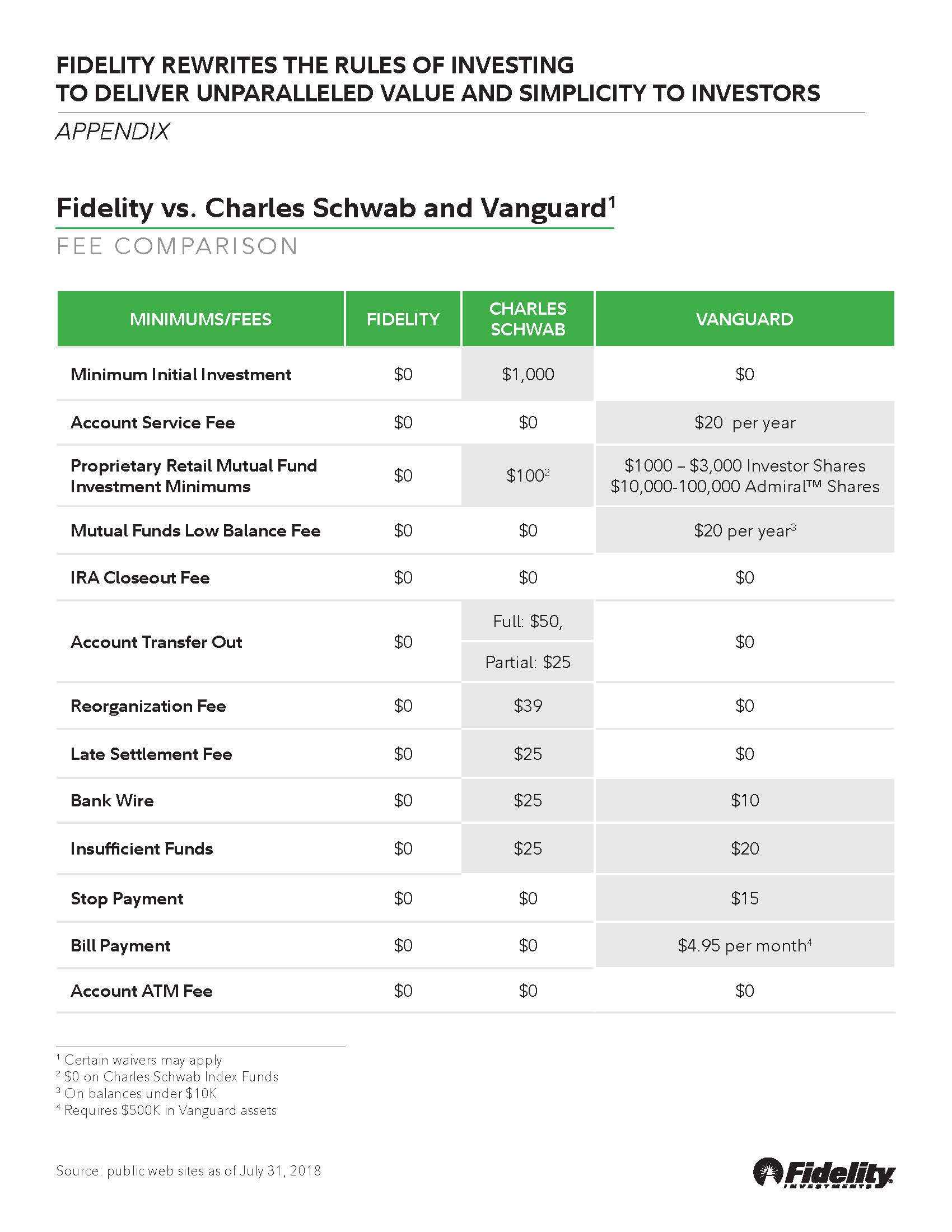

Fidelity Rewrites The Rules Of Investing To Deliver Unparalleled Value And Simplicity To Investors Business Wire

Fidelity Rewrites The Rules Of Investing To Deliver Unparalleled Value And Simplicity To Investors Business Wire

Fidelity Short Selling Stocks How To Sell Short 2021

Fidelity Short Selling Stocks How To Sell Short 2021

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

:max_bytes(150000):strip_icc()/Fid.comLandingPage-b1a8470d09c34e3db49f1810ac96acf2.png)

Comments

Post a Comment