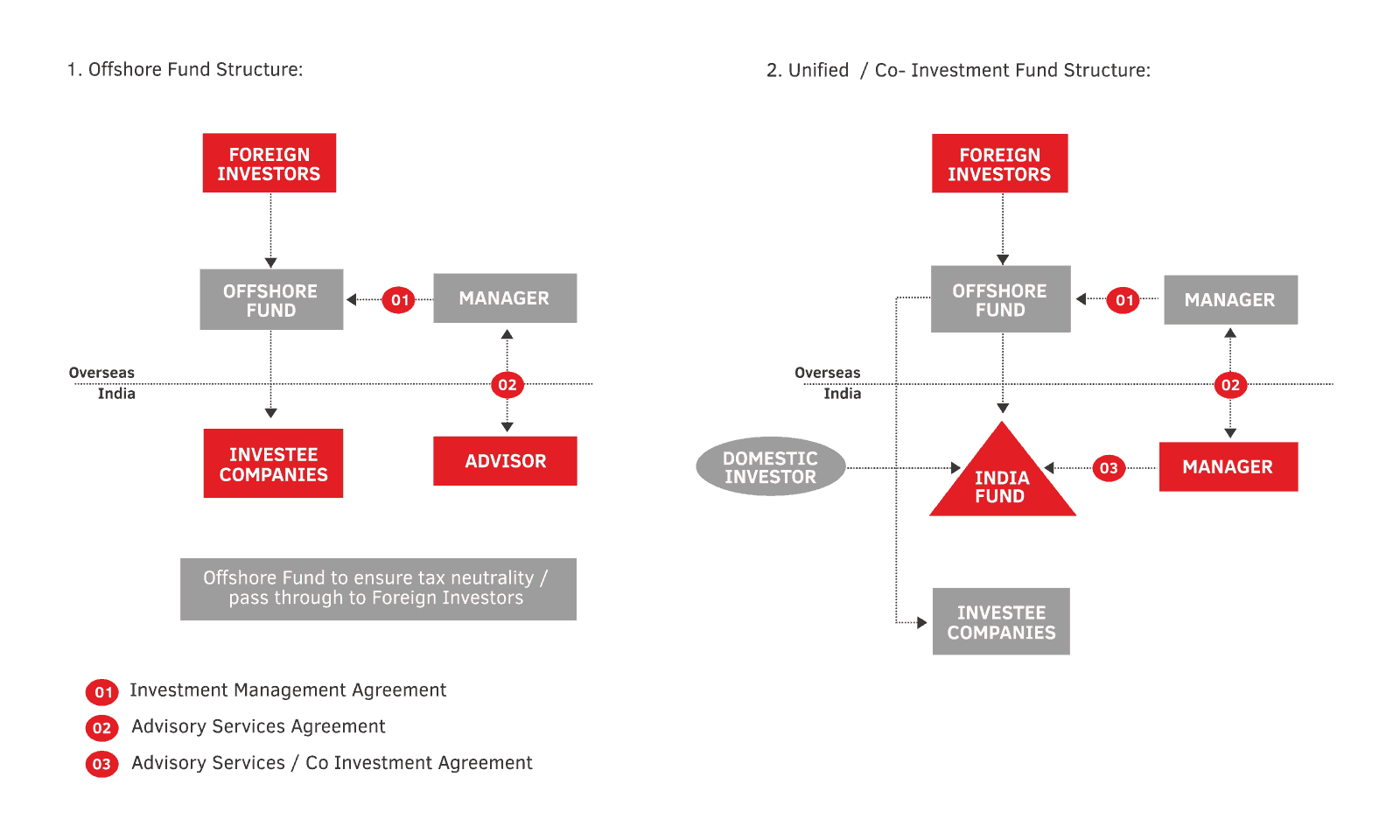

Alternative Investment Fund AIF means any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from investors Indian or foreign for investing it in accordance with a defined investment policy for the benefit ofits investors. Kotak Realty Fund is one of Indias leading private equity real estate funds with USD 22 billion of aggregate capital commitments.

Real Estate Investment Trust Reits

Real Estate Investment Trust Reits

They mainly invest in real estate sector across the globe.

India real estate investment fund. Private equity investment volumes for. Fund managers are responsible for the choice made between the two options. Real Estate Mutual Funds.

Backed by the largest private sector bank in India and one of the worlds oldest international. Even as the real estate industry in India hopes for bigger relief measures following a nationwide lockdown to contain the coronavirus pandemic a rescue fund set up for the sector last year is yet to disburse money for select stressed projects. Currently there are no real estate.

This scheme is launched by Aditya Birla Sun Life. Over 835 of these funds were infused by them as equity capital indicating their appetite for Indian real estate sector. We are one of the most pre-eminent real estate investors in India having over 10 years of real estate investing experience across key Indian citiesOur difference lies in our ability to navigate through dynamic market conditions while remaining focused on meeting our clients goals.

Features of Real Estate Mutual Fund Schemes. REITs invest directly in real estate and own operate or finance income-producing properties. The Real estate mutual.

Accrue a minimum 75 of gross income from mortgage interest or rents. As a home buyer you are required to go through an arduous process before you get the property registered in your. There is only one real estate fund in India.

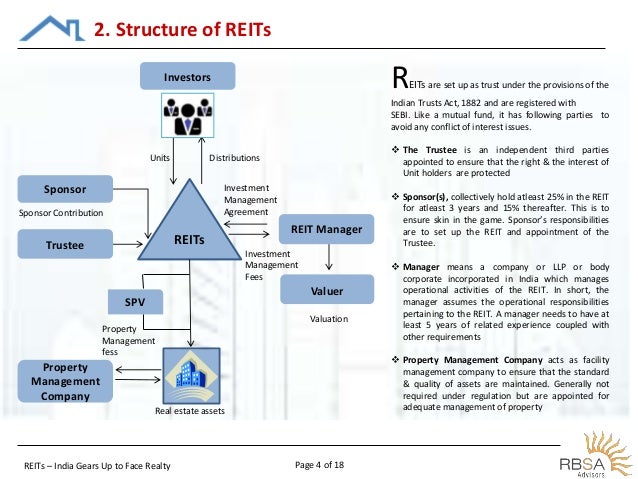

The Real Estate Mutual Funds REMFs invest either directly in real estate companies or through the Real Estate Investment Trust REIT. REITs trade on major. Private equity firms interest in Indian real estate continues unabated as their investment in the sector during the first three quarters of 2019 rose to Rs 39182 crore up 19 from a year ago period.

The government-led alternative investment fund with a starting corpus of Rs 10000 crore is yet to. Regulations governing REITs and InvITs were introduced in India. In the backdrop of an ongoing transformation in business environment Indian real estate is witnessing a robust rise in investment inflow as both foreign and domestic institutional investors are infusing more funds into the sector.

95 of this funds portfolio constituent is taken by ING Global Real Estate Fund. A Real Estate Fund is a Sector Fund which predominantly invests in securities which are provided by companies which invest in real estate projects. The 25000 crore Alternative Investment Fund.

In essence it is a fund which provides capital and investment which can be used by the real estate company to develop properties. From first looks the long-awaited package to support the real estate sector cleared by the Cabinet on Wednesday appears well-designed. Finance minister Nirmala Sitharaman recently announced setting up of a 25000 crore alternative investment fund to provide last-mile funding for stalled housing projects.

A maximum of 20 of the corporations assets comprises stock under taxable REIT subsidiaries. This fund is managed by professionals with investments primarily in stocks of such developers. Real estate is undoubtedly the most popular investment option in India.

The Indian property market has posted a 40 on-year jump in inflow of funds since the beginning of this year. Real estate funds typically invest in REITs and real estate-related stocks. On the backdrop of the liquidity squeeze private equity funds have invested 38 billion in Indian real estate in the first nine months of the calendar year 19 higher than the 32 billion invested during the same period a year ago.

Some of the prominent companies promoting real estate funds in India are HDFC Property Fund DHFL Venture Capital Fund Kotak Mahindra Realty Fund Kshitij Venture Capital Fund A group venture of Pantaloon Retail India Ltd and ICICIs real estate fund India Advantage Fund. Hassle-free real estate investing Purchasing a property is a time-consuming process. A minimum of 75 of investment assets must be in real estate.

Here are some salient features of real estate mutual funds available in India-Investment horizon These funds are recommended to investors with a long-term investment horizon. Real estate investment trusts REITs and Infrastructure investment trusts InvITs are investment vehicles that can be used to attract investment in the infrastructure and real estate sectors and also relieve the burden on formal banking institutions. It comes under Fund of Funds category.

Real Estate Vs Mutual Fund Which Is A Better Investment

Real Estate Vs Mutual Fund Which Is A Better Investment

Funds Reit Invit Transaction Square

Funds Reit Invit Transaction Square

Nishith Desai Associates Demystifying Real Estate Platforms

Nishith Desai Associates Demystifying Real Estate Platforms

Property Investment How To Invest In Real Estate In India For Beginners Getmoneyrich

Property Investment How To Invest In Real Estate In India For Beginners Getmoneyrich

Investing In Real Estate Is Hardly A Lucrative Bet Now

Investing In Real Estate Is Hardly A Lucrative Bet Now

What Are Real Estate Investment Trusts Are They Active In India Now Finserv Markets

What Are Real Estate Investment Trusts Are They Active In India Now Finserv Markets

Which Is Better Option To Invest Fd Vs Property Vs Mutual Fund Vs Gold Sanriya

Which Is Better Option To Invest Fd Vs Property Vs Mutual Fund Vs Gold Sanriya

Property Investment How To Invest In Real Estate In India For Beginners Getmoneyrich

Property Investment How To Invest In Real Estate In India For Beginners Getmoneyrich

Property Investment How To Invest In Real Estate In India For Beginners Getmoneyrich

Property Investment How To Invest In Real Estate In India For Beginners Getmoneyrich

India S First Reit Is Finally Here Should You Invest

India S First Reit Is Finally Here Should You Invest

Property Investment How To Invest In Real Estate In India For Beginners Getmoneyrich

Property Investment How To Invest In Real Estate In India For Beginners Getmoneyrich

Why Real Estate Investment In India Is The Most Reliable

Why Real Estate Investment In India Is The Most Reliable

Is Real Estate In India Still A Profitable Investment The Financial Express

Is Real Estate In India Still A Profitable Investment The Financial Express

Private Equity Investments In Real Estate Gain Traction Says Report Business Standard News

Private Equity Investments In Real Estate Gain Traction Says Report Business Standard News

Comments

Post a Comment