E-file your expat taxes instantly with Expatfile. Yes you have to pay taxes but you dont have to file returns anymore.

Taxes On Stocks How Do They Work Forbes Advisor

Taxes On Stocks How Do They Work Forbes Advisor

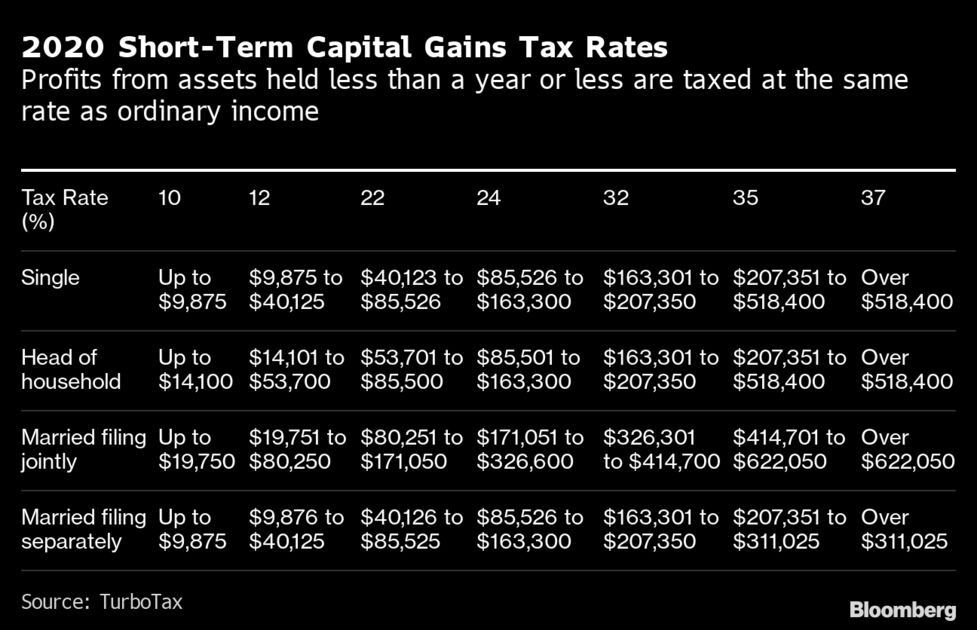

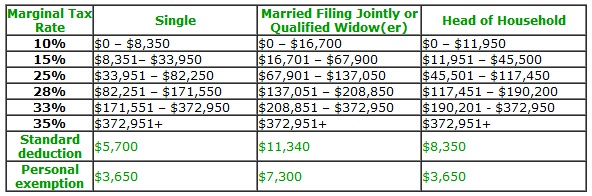

Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less.

Do you file taxes on stocks. No matter how many statutory or non-statutory stock options you receive you typically dont have to report them when you file your taxes until you exercise those options unless the option is actively traded on an established market or its value can be readily determined. E-file your expat taxes instantly with Expatfile. Federal income taxes are due on April 15.

Paying Taxes on Stocks Dividends If you own a stock or mutual fund that pays dividends which is a payment of cash or stock given to owners of the stock by the issuing company you. Annons Expats can now e-file their 2020 expat taxes in as quick as 10 minutes. To determine how much you owe in capital gains tax after selling a stock you need to know your basis which is the cost of the stock along with any reinvested dividends and commissions paid.

Meanwhile stocks that are held for at least. A few clients recently asked me Do I need to enter every stock transaction if i use an online tax prep software such as Turbo Tax or Tax Act and it cannot import transactions from Interactive Brokers. This is your taxes on stocks explained for beginners tutorial and this is perfect for you if you are new to the stock market or you are a beginner in the sto.

Youre only required to pay taxes on your profit so that means you can subtract the amount you paid for the stock when you originally bought it. What Happens If You Dont Pay Your Stock Trading Taxes. When you sell investmentssuch as stocks bonds mutual funds and other securitiesfor a profit its called a capital gain.

If you make stock trades during the year your financial services firm will send you a Form 1099-B at the end of the year with relevant information for your taxes. It is Tax season in the US. So do you really have to list every single trade.

Or Do I have to use the desktop version. Youll get one 1099-B from each. Select Stocks Select Tax Documents Select the 2020 1099-B Cash App Investing will provide an annual Composite Form 1099 to customers who qualify for one.

Therefore you do not have to worry about offsetting any such gains by taking capital. No more waiting just e-file now. Stocks that are held for a year or less are subject to short-term capital gains taxes which mimic the marginal tax rates that apply to ordinary income.

Some traders handle this problem by purchasing and utilizing software to help them list our their trading history in an exportable format. It was a simple tax return but the preparer listed every single trade separately. Then they provide those files to specialist CPAs and EAs who often charge a premium rate.

No you do not. If you sold stocks at a profit you will owe taxes on gains from your stocks. The Composite Form 1099 will list any gains or losses from those shares.

If youre investing in the stock market that means youre investing in a listed company. When you file your annual tax. No more waiting just e-file now.

I recently saw a tax return from a client who switched over to our service that had a 1200 bill on it. Stock traders that dont trade professionally might not think of their profits as income but you. And if you earned dividends or.

Annons Expats can now e-file their 2020 expat taxes in as quick as 10 minutes. For tax year 2018 if you are in the 10 or 12 tax bracket you are not liable for any taxes on capital gains. If you did not sell stock or did not receive at least 10 worth of dividends you will not receive a Composite Form 1099 for a given tax year.

If you sold stocks at a loss you might get to write off up to 3000 of those losses.

Understanding The Tax Implications Of Stock Trading Ally

Understanding The Tax Implications Of Stock Trading Ally

Do I Have To Pay Taxes On Gains From Stocks Kiplinger

Do I Have To Pay Taxes On Gains From Stocks Kiplinger

/Taxes-b5743df0be814fe9a34c2f2255f47fb2.jpg) Will I Have To Pay Taxes On Any Stocks I Own

Will I Have To Pay Taxes On Any Stocks I Own

How To File Robinhood 1099 Taxes

How To File Robinhood 1099 Taxes

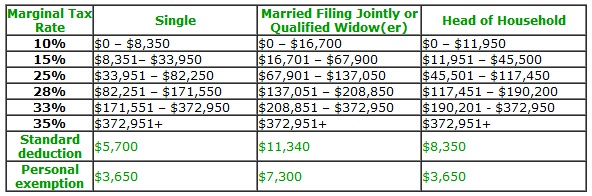

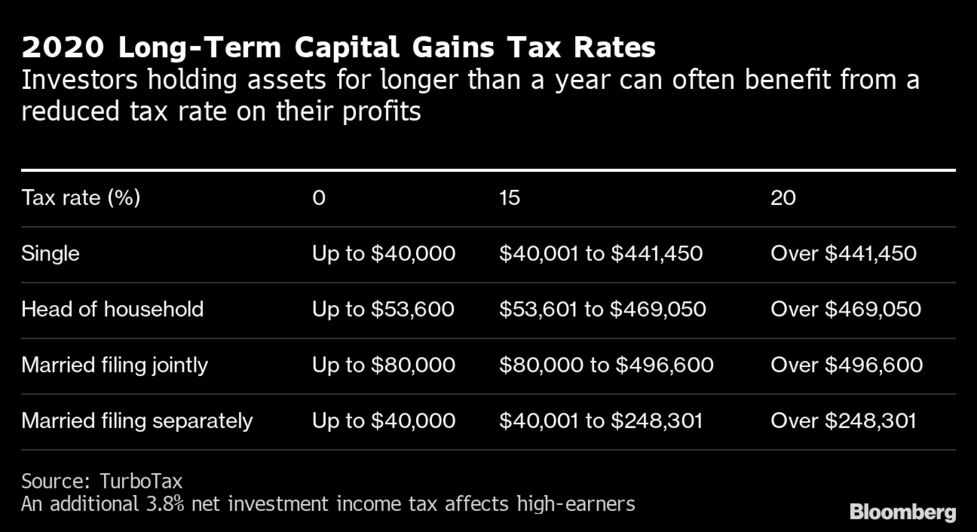

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

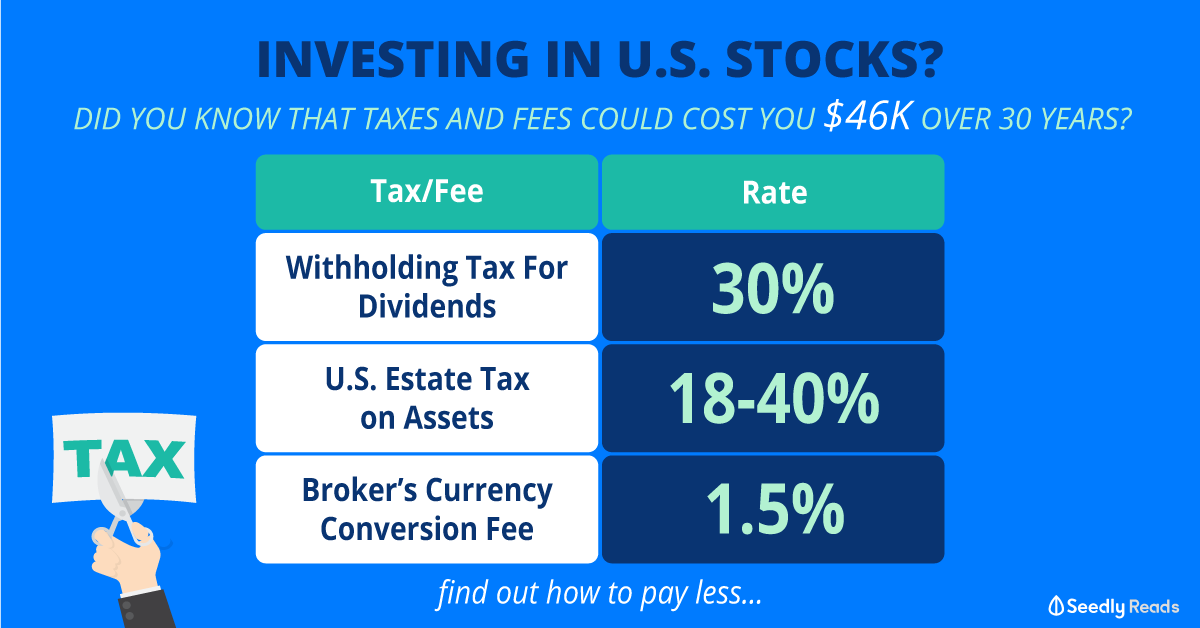

Definitive U S Stock Investing Taxes And Fees Guide For Singaporean Investors

Definitive U S Stock Investing Taxes And Fees Guide For Singaporean Investors

How Brokerage Accounts Are Taxed In 2021 A Guide

How Brokerage Accounts Are Taxed In 2021 A Guide

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

How To Deduct Stock Losses From Your Taxes Bankrate

How To Deduct Stock Losses From Your Taxes Bankrate

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Comments

Post a Comment