The biggest chunk comes from individuals with high net worth. If you already manage money at a bank or hedge fund then you have a huge leg up on the rest of us.

Twenty Tips On How To Raise Capital For A Hedge Fund

Twenty Tips On How To Raise Capital For A Hedge Fund

Legal Implications of Raising Capital for a Hedge Fund.

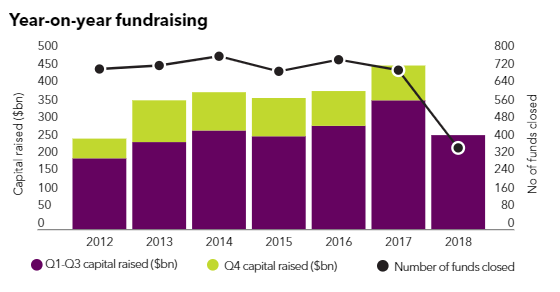

How to raise money for a hedge fund. How a Hedge Fund Raises Money A hedge fund raises its capital from a variety of sources including high net worth individuals corporations foundations endowments and. Crowdsourced from over 500000 members. It is difficult to raise capital for a new fund but certainly not impossible.

How does a hedge fund raise money. You need to review your employment agreement and see what it allows because firms have different policies. Performance is only one.

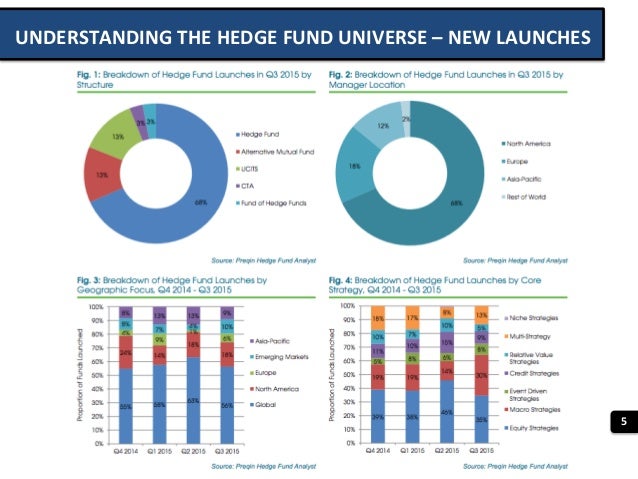

Traditionally there were several avenues by which hedge funds could raise capital. Hedge funds raise money from individual and institutional investors who contribute capital in exchange for interests in the fund entity. Generally hedge fund managers do not seek funds from small individual investors.

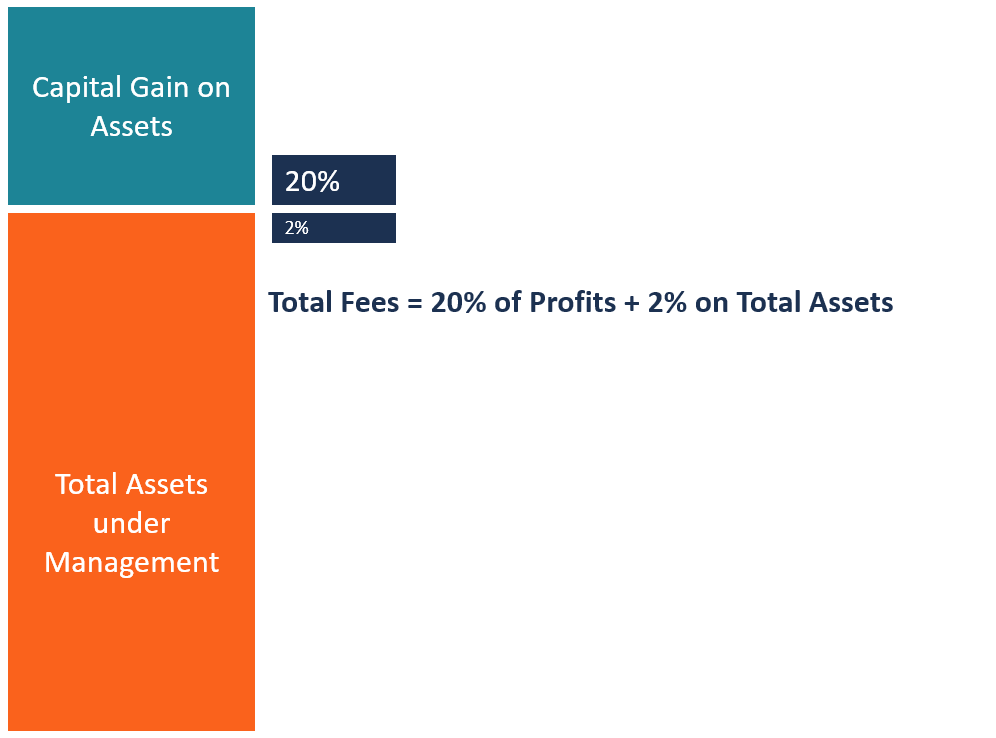

Funds make their money by charging fees on the assets they manage and the performance they manage on those assets. First note that even if you do have a solid track record at an established firm you may not be able to use your results for marketing purposes. As such Linear Investments routinely ensures its hedge fund clients are introduced to funds of hedge funds family offices and HNWIs to help them raise early-stage capital.

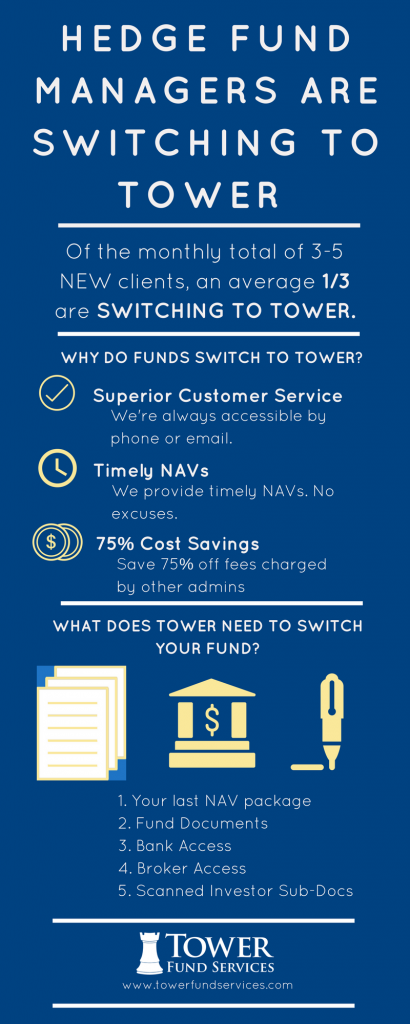

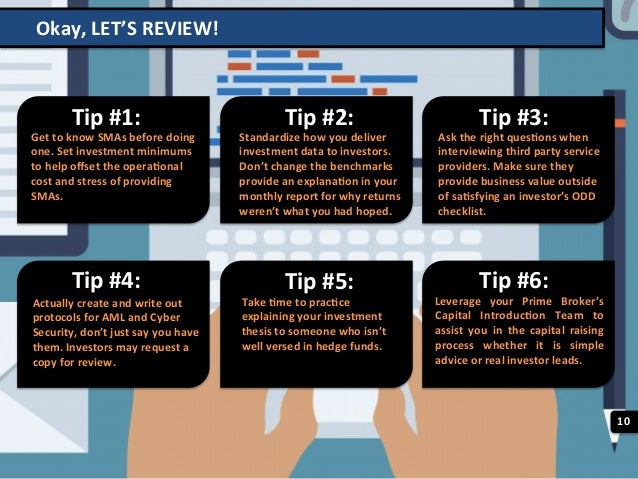

Targeted sales and carefully orchestrated meetings with prospective clients was the most obvious approach although capital raising events organised by prime brokerage teams sometimes yielded success too. Procure a seed deal from a Family OfficeFOF or Emerging Manager Platform 2. Trusted by over 1000 aspiring hedge fund professionals just like you.

These can become highly profitable investment vehicles when managed carefully and to do this hedge fund managers use a number of trading strategies that well go on to examine so you can learn from them too. As Jon said a portable track-record from your previous firm or as the manager of a prior fund will be extremely helpful. HOW TO START A HEDGE FUND WITH NO MONEY AND MAKE A BILLION DOLLAR.

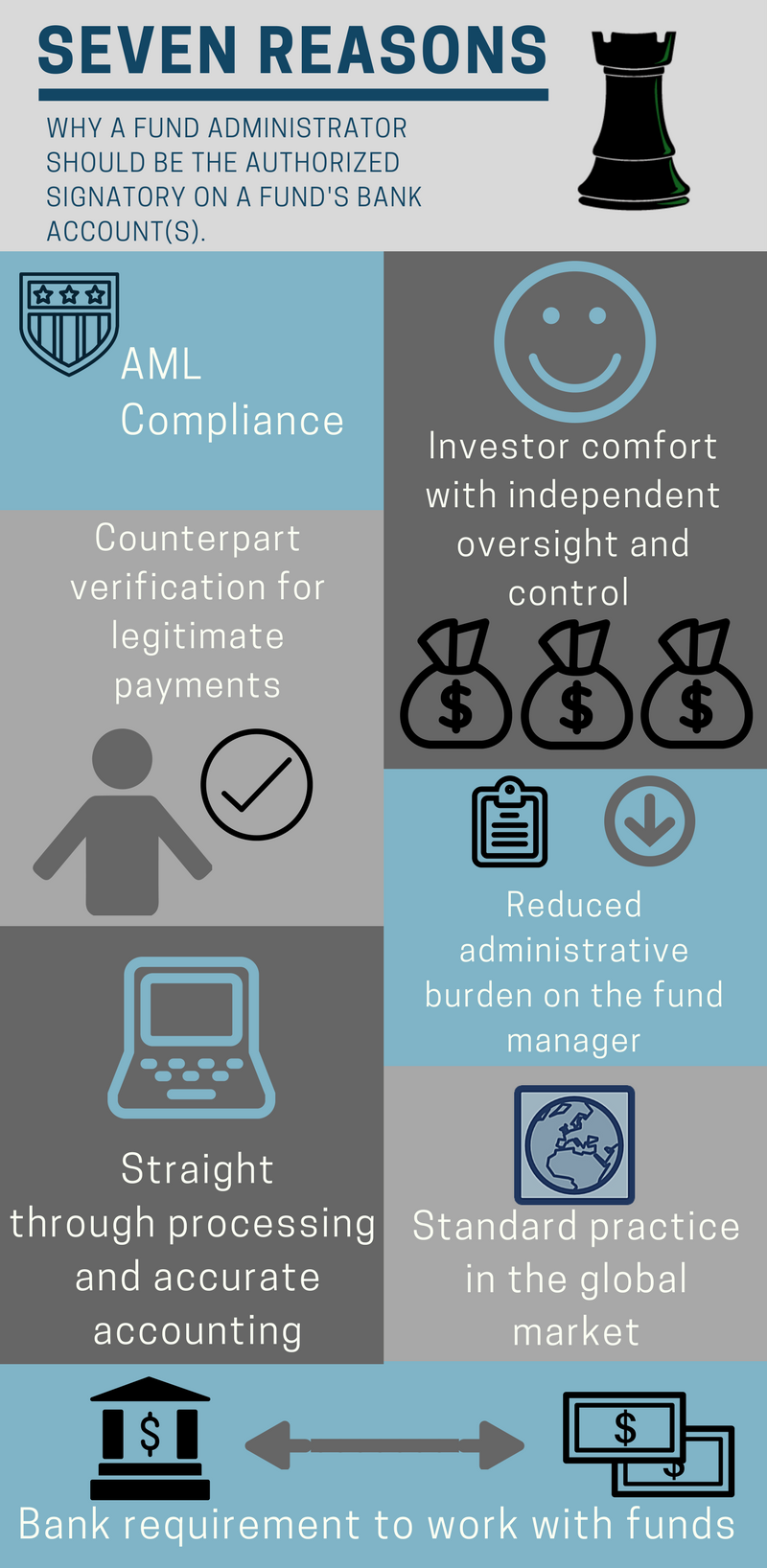

To be optimally prepared and positioned the following 7 key marketing points are offered to help new sub-100 million AUM managers and sub-institutional funds with marketing and raising assets. I will be discussing other ways to raise capital in subsequent articles. There are also other contributors like foundations endowments corporations and pension funds.

In other words they charge 2 of the assets to manage them and then 20 on performance if the assets increase in value. Because hedge funds are generally prohibited from using any public advertising to attract potential investors hedge funds are typically marketed through close networks. For everyone else the hardest part of starting your hedge fund is raising money.

Such non-traditional ways include. You generally only have two realistic options. In the hedge fund industry it actually becomes exponentially easier to raise capital the more capital you have.

Utilizing the services of a third party marketer capital introduction services hedge fund conferences and hedge fund databases. For any high net worth individual looking for somewhere to invest at least a portion of their money a hedge fund is a logical choice. HOW TO START A HEDGE FUND WITH NO MONEY AND MAKE A BILLION DOLLAR - YouTube.

Some hedge funds dont let their traders take their performance sheets with them so they might need to manage money on their own for a while to build up a fresh record. 11 Detailed Sample Pitches and 10 hours of video. How to Start a Hedge Fund Part 1.

814 questions across 165 hedge funds. You can also have excellent investment strategies so that institutional investors are attracted to your hedge fund. There are several sources from where hedge fund managers raise their monies.

Boutique prime brokers such as Linear Investments recognise that smaller hedge funds need to be introduced to the correct investors. Business Insider asked a bunch of experts what it takes to raise a hedge fund from the ground up in 2017. Distinctly separate but critically.

Getting institutional investors is an excellent way to raise capital for hedge fund. Astute proactive funds are always focused on forward opportunities to raise assets. The traditional fee structure for investing in hedge funds is 2 and 20 which means a management fee of 2 and a performance fee of 20.

Non-tradtional forms of raising hedge fund capital. Getting investment from institutional investors require long term planning and strategy. These services give you access to the same legal templates.

The final option is to use a hedge fund formation template service which could cut costs and reduce your startup expenses by 60 to 90.

Twenty Tips On How To Raise Capital For A Hedge Fund

Twenty Tips On How To Raise Capital For A Hedge Fund

The Hedge Fund Book A Training Manual For Professionals And Capital Raising Executives Wiley

The Hedge Fund Book A Training Manual For Professionals And Capital Raising Executives Wiley

Managing A Hedge Fund Marketing To Investors Raising Capital

Managing A Hedge Fund Marketing To Investors Raising Capital

Infographic What Is A Hedge Fund

Infographic What Is A Hedge Fund

How To Find Investors And Raise Capital For Hedge Fund

How To Find Investors And Raise Capital For Hedge Fund

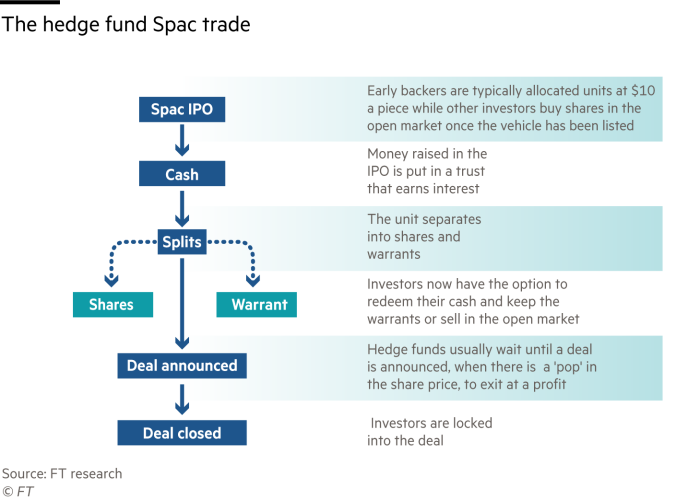

How Hedge Funds Are Fuelling The Spac Boom Financial Times

How Hedge Funds Are Fuelling The Spac Boom Financial Times

Private Equity Hedge Funds Investment Vehicles In The U S Executive Summary Investmentbank Com

Private Equity Hedge Funds Investment Vehicles In The U S Executive Summary Investmentbank Com

Amazon Com Hedge Fund Marketing How Smart Hedge Funds Operate To Get Investors And Raise Aum Ebook Verial Damon Kindle Store

Amazon Com Hedge Fund Marketing How Smart Hedge Funds Operate To Get Investors And Raise Aum Ebook Verial Damon Kindle Store

How To Raise Money To Launch A Hedge Fund

How To Raise Capital For A Hedge Fund Financial Market News

How To Raise Capital For A Hedge Fund Financial Market News

Download Pdf Hedge Fund Business Plan And Capital Raising Guide

Download Pdf Hedge Fund Business Plan And Capital Raising Guide

Managing A Hedge Fund Marketing To Investors Raising Capital

Managing A Hedge Fund Marketing To Investors Raising Capital

How To Start A Hedge Fund Formation Raising Capital Team And Life

How To Start A Hedge Fund Formation Raising Capital Team And Life

Comments

Post a Comment