Select Create W-2s and 1099s. If you do need to attach your 1099 to your tax return make sure you do so correctly.

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Turbotax Form 1099 K.

Send 1099 turbotax. Irs Employer 1099 Forms. Payers use IRS Form 1099 INT when the interest paid to the investor is 10 or more during the year. Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021.

Available in mobile app only. If you e-file you do not need to send your W-2 and 1099-MISC to the IRS. Also remember you can E-file your 1099-misc forms so you dont have to send anything to the IRS yourself the software will do it for you.

To enter additional 1099-Rs after entering one please follow these steps. Turbotax Form 1099 S. Turbotax 1099 R Forms.

Available in mobile app only. 2192021 The 1099-INT is a form you must submit if youve earned more than 10 in interest from a bank. Available in mobile app only.

Scroll down to the Retirement Plans and Social Security section and click on the StartRevisit box next to IRA 4701k Pension Plan Withdrawals 1099-R. Once you are done just print the 1099-misc form and give the forms to the contractors. Select Other self-employed income.

If youve already entered one or more 1099-Rs you will see a screen Your 1099-R Entries. 622019 Heres how to enter 1099-INT in TurboTax. Turbotax Home And Business 2014 And Best Of Turbotax 1099 Forms.

Edit Required to send 1099s even if you. Just keep them for your records. If you paper-file file by mail youll need to attach your W-2 forms Copy B to your tax return.

Open or continue your return. After signing in to TurboTax open or continue your return. Select Continue when finished.

Turbotax Form 1099 G. Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. 1099-NEC Snap and Autofill.

Click on Federal Wages Income. In the pop-up window select Topic Search. Income listed on a 1099-R form can be taxable or tax-free and if you have withdrawn money before retirement age may be subject to early distribution penalties.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. Select Review beside Self-Employment income Review beside the business. Search for Schedule C and select the Jump to link in the search results.

Link to Amazon offer httpamznto1PehyDaStart Date. The deadline for sending a 1099-MISC to a recipient is January 31 or the following business day which means the people you send this form to for tax year 2020 must receive it by February 1 2021. TurboTax and 1099-MISC BlockFi - Can you provide a step-by-step guide on how to enter the 1099-MISC into TurboTax Online.

Instructions for TurboTax Self-Employed and TurboTax Self-Employed Live. On the Tell us about other self-employed income for your type of business work screen enter your 1099-K information. Turbotax Form 1099 Q.

Turbotax Form 1099 Sa. If your return isnt open youll need to sign in and click Take me to my return Click the drop-down arrow next to Tax Tools lower left of your screen. Turbotax Form 1099 Int.

If the answer is yes you may want to learn about your potential 1099-MISC filing requirement. 24 posts related to Turbotax 1099 Quick Employer Forms. You can fill out 1099-MISCs and W-2s online by going to Quick Employer Forms from TurboTax.

Select Tax Home from the left-side menu you might already be there Scroll down and select Your account. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. Open continue your return in TurboTax.

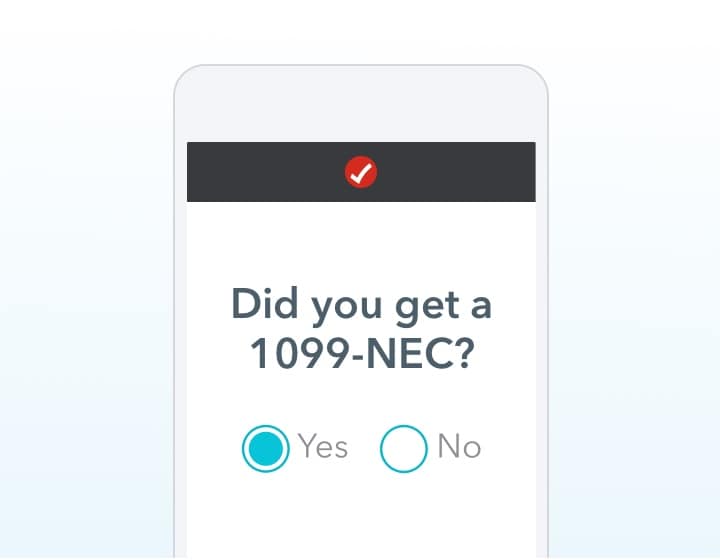

Turbotax Form 1099 B. There is a new Form 1099-NEC stand for non-employee compensation that must be used for those you have paid for services that is greater than 600. 1099-NEC Snap and Autofill.

Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. Located in the top right corner of each schedule or form that lets you know in which order these forms. There is an Attachment Sequence No.

Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. Jan 30 2016 If you dont want to buy through Amazon You can price match it at. 1099 For Former Employer.

Jan 20 2016End Date. I am no tax expert and it is really confusing. Open continue your return in TurboTax Self-Employed.

The due date for filing Form 1099-MISC with the IRS is February 28 2021 if you file on paper or March 31 2021 if you file electronically. 1099-NEC Snap and Autofill. Turbotax 1099 Misc Forms.

A 1099-R form records distributions you received during the year from certain retirement accounts including 401k 403b and IRA accounts. When you are signed into your TurboTax Online account Select Income Expenses tab. Inside TurboTax search for 1099-INT and select the Jump to link in the search results.

To create a Form 1099-MISC in TurboTax Self-Employed. Like with most things concerning the IRS there are very specific rules and requirements regarding the way forms must be attached to your tax return. How do I enter a 1099-K in TurboTax Online.

Many people use automated tax-return programs such as the Internet-based TurboTax.

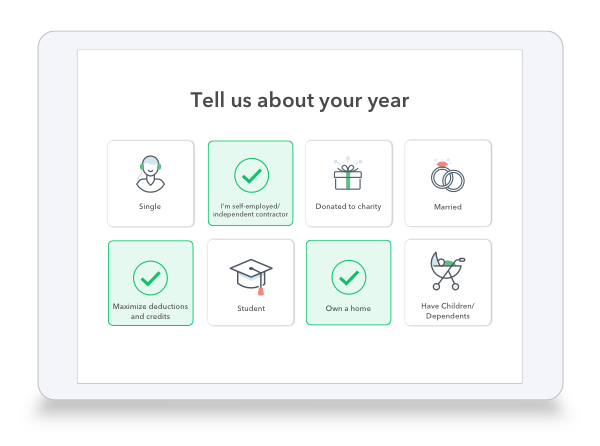

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Best Tax Filing Software 2021 Reviews By Wirecutter

Best Tax Filing Software 2021 Reviews By Wirecutter

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Review 2021 The Easiest Tax Software To Use

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Solved How Do I Issue 1099 Misc

Solved How Do I Issue 1099 Misc

Solved How Do I Issue 1099 Misc

Solved How Do I Issue 1099 Misc

Turbotax Review 2021 Nerdwallet

Turbotax Review 2021 Nerdwallet

How To File Taxes With Irs Form 1099 Nec Turbotax Tax Tips Videos

How To File Taxes With Irs Form 1099 Nec Turbotax Tax Tips Videos

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Comments

Post a Comment