Direxion Daily S. There are 10 biotech ETFs that trade in the US excluding inverse and leveraged ETFs as well as funds with less than 50 million in assets under management AUM.

Consider These 2 Leveraged Biotech Etfs To Ride The M A Trend Etf Trends

Consider These 2 Leveraged Biotech Etfs To Ride The M A Trend Etf Trends

There is no guarantee the funds will meet their stated investment objectives.

Leveraged biotech etf. The UltraShort Nasdaq Biotechnology BIS. April 2016 verfügte der Fonds über ein Gesamtnettovermögen von 483 Mio. Vergleich von Leveraged Biotech ETFs - 2021 - Talkin go money Week 2 Kann 2021.

Der Invesco NASDAQ Biotech UCITS ETF ermöglicht Anlegern in aufstrebende Biotechnologie- und Pharmatitel mit Listing am NASDAQ Stock Market zu investieren. The Direxion Daily SP Biotech Bull LABU and Bear LABD 3X Shares seek daily investment results before fees and expenses of 300 or 300 of the inverse or opposite of the performance of the SP Biotechnology Select Industry Index. Die Biotech-Branche florierte zwichen 2011 und dem 19.

ProShares a leading provider of leveraged and inverse ETFs announced the launch on Friday of the first ETFs with leveraged and inverse exposure to the biotechnology sector. Die Biotech-Industrie florierte zwischen 2011 und dem 19. Zum besseren Vergleich finden Sie eine Liste aller Biotech-ETFs mit Angaben zu Größe Kosten Ertragsverwendung Fondsdomizil und Replikationsmethode sortiert nach Fondsgröße.

The fund is similar to the ProShares Ultra Biotech ETF and provides leveraged exposure to its underlying index. Go where theres opportunity with bull and bear funds for both sides of the trade. Der ProShares Ultra Biotechnologie ETF.

The Ultra Nasdaq Biotechnology BIB will seek to provide 200 of the return on the NASDAQ Biotechnology Index for a single day. Whether youre a bull or a bear Direxion is with you. ARKG ARK Genomic Revolution ETF.

Biotech ETFs can be found in the following asset classes. The product has amassed about 603 million in its asset base while charging 95 bps in fees per year. LABU is a leveraged ETF that was issued by Direxion on May 28 2015.

Der NASDAQ Biotechnologie Index ist nach Marktkapitalisierung gewichtet und enthält 116 Komponenten die nach der Industry Classification Benchmark ICB als Biotechnologie. The 3 Best Biotech ETFs. NASDAQ Biotechnology Index This 7861-million ETF trades in volumes of about one million shares a day and charges 95 bps in fees.

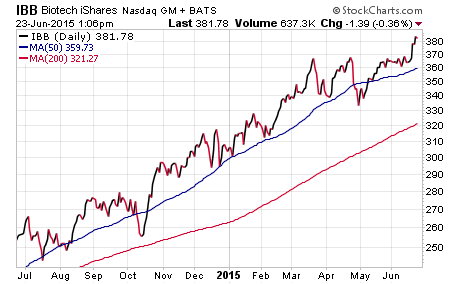

April 2016 und die wichtigten Indize haben ich in dieem Zeitraum nahezu verdreifacht. The Direxion Daily SP Biotech Bull 3X Shares ETF. IBB iShares Nasdaq Biotechnology ETF.

One can also find leveraged biotech ETFs which attempt to magnify the returns generated by the underlying biotech index by a particular factor. This ETF offers three times leveraged exposure to the SP Retail Select Industry Index. The Direxion Daily SP Biotech Bull 3X Fund NYSEARCA.

With 17 ETFs traded on the US. The average expense ratio is 069. Der tägliche S.

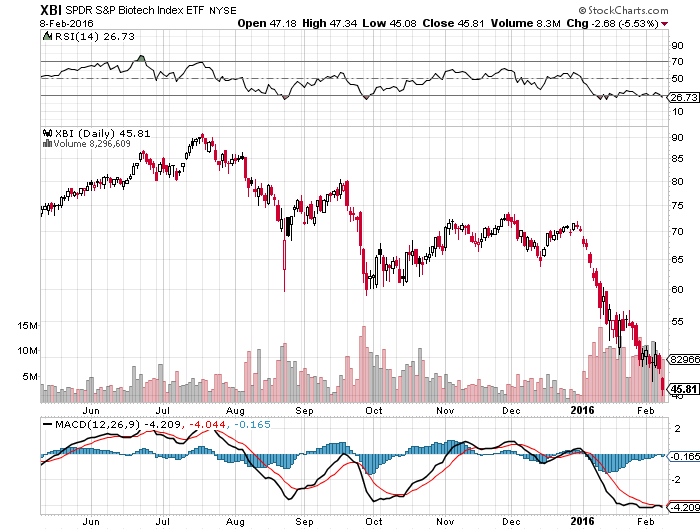

Our leveraged ETFs are powerful tools built to help you. Stay agile with liquidity to trade through rapidly changing markets. XBI SPDR S.

Magnify your short-term perspective with daily 3X leverage. Für die Auswahl eines ETF auf Biotech sind neben der Methodik des Index und der Wertentwicklung weitere Faktoren für die Entscheidungsfindung wichtig. For instance there is the Direxion Daily SP Biotech Bear 3x Shares LABD ETF which magnifies the returns of the underlying biotech index by a factor of -3 while the Direxion Daily SP Biotech Bull 3x Shares LABU ETF magnifies the returns.

In this investment guide you will find all the ETFs that give you exposure to biotech stocks. For investors looking for more rapid gains and willing to bear the risks here are 2 Direxion Leveraged 3X ETFs focusing on the biotech stocks. Markets Biotech ETFs have total assets under management of 2046B.

Der Fonds ist ein traditioneller Leveraged-ETF der hauptsächlich Swap-Kontrakte auf seinen zugrunde liegenden Index den NASDAQ Biotechnology Index und Stammaktien von Unternehmen hält aus denen der Index besteht. Biotech indices track companies that are active in these fields as well as firms that provide the relevant infrastructure. ETF issuers who have ETFs with exposure to Biotechnology are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields.

The metric calculations are based on US-listed Biotechnology ETFs and every Biotechnology ETF has one issuer. USD und wurde von ProShares Advisors LLC beraten. 2x Benchmark Index.

Direxion Daily Biotech 3X ETFs. Where to Buy These Biotech ETFs. ProShares Ultra Biotechnology ETF.

In dieer Zeit inbeondere im Jahr 2015 hat die Branche j. Die Biotech-Branche florierte zwischen 2011 und dem 19. Currently there is 1 index available tracked by 2 ETFs.

3 Direxion Etfs Top List Of Best Leveraged Performers

3 Direxion Etfs Top List Of Best Leveraged Performers

A New Bearish Biotech Etf And A Lazarus Act For A Couple Leveraged Funds

A New Bearish Biotech Etf And A Lazarus Act For A Couple Leveraged Funds

/GettyImages-1212470616-072494eaffcb48bfa8ee9ae0afc2bf20.jpg) Bib Versus Labu Comparing Leveraged Biotech Etfs

Bib Versus Labu Comparing Leveraged Biotech Etfs

Biotech Etfs Kaufen Beste Biotech Etfs 2021 Im Vergleich

Biotech Etfs Kaufen Beste Biotech Etfs 2021 Im Vergleich

Where To Buy Booming Biotech Etfs

:max_bytes(150000):strip_icc()/GettyImages-1073823296-d9a79409c53e4bdfa559e574c5a00302.jpg) Bib Versus Labu Comparing Leveraged Biotech Etfs

Bib Versus Labu Comparing Leveraged Biotech Etfs

Biotech Etf Pillen Furs Portfolio 12 08 18 Borse Online

Biotech Etf Pillen Furs Portfolio 12 08 18 Borse Online

Proshares Releases 2 New Leveraged Biotech Etfs

Proshares Releases 2 New Leveraged Biotech Etfs

Consider These 2 Leveraged Biotech Etfs To Ride The M A Trend Etf Trends

Consider These 2 Leveraged Biotech Etfs To Ride The M A Trend Etf Trends

Direxion Daily S P Biotech Bull 3x Shares Etf Us25490k3234

Short Sellers Back Off From Biotech Etfs

Short Sellers Back Off From Biotech Etfs

Biden S Infrastructure Can Put These 2 Leveraged Funds In Play Nasdaq

Biden S Infrastructure Can Put These 2 Leveraged Funds In Play Nasdaq

Biotech Etfs Welcher Ist Der Beste Justetf

Biotech Etfs Welcher Ist Der Beste Justetf

The S P Biotech Etf Xbi And Corresponding Leveraged Etf Labu Hit My Downside Target But Now Need To Rally Robert Edwards Seeking Alpha

The S P Biotech Etf Xbi And Corresponding Leveraged Etf Labu Hit My Downside Target But Now Need To Rally Robert Edwards Seeking Alpha

Comments

Post a Comment